When was the last time your company took a fresh look at the executive severance program? Severance arrangement reviews are often not an annual agenda topic for the compensation committee. However, shifting market trends in change-in-control (CIC) severance arrangements suggest a re-examination of current plans may be warranted.

Meridian recently published a Study of Executive Change-in-Control Arrangements, which provides insights on prevailing market practices and emerging trends in executive severance benefits in connection with a CIC event. The survey focused on CIC severance practices at 200 large U.S. public companies. As companies review severance plans and policies to assess whether their current structure continues to meet desired objectives, it is essential to understand how market practices have shifted in recent years.

Evaluating CIC severance arrangements starts with understanding the purpose of the program and the fundamental plan objectives. Generally, the purpose of most CIC severance plans is to:

• Keep executives neutral to job loss while pursuing potential value-adding transactions;

• Retain key talent in the face of heightened uncertainty; and

• Maintain competitive benefits to attract and retain top talent.

Additional objectives may also consider consistency across plan participants, company protection by way of restrictive covenants and releases and ease of administration.

Forms of CIC Plans

CIC arrangements generally take one of two forms, as a severance plan that provides protection to a group of executives or as an individual employment/severance agreement. Although both forms are widely used, we’ve observed a recent and significant shift toward CIC severance plans. Companies are transitioning away from individual agreements for multiple reasons. Most notably, severance plans ensure uniformity of terms and provisions, enable adjustments across all covered executives and are far easier to administer and communicate.

CIC Cash Severance Benefits

Meridian’s survey examines the structure of cash severance benefits and highlights design changes observed over the past several years. The basic structure of cash severance is unchanged. Most companies continue to provide these benefits to a select group of senior executives, structured as a multiple of salary and annual bonus. The majority of companies define bonus as “target,” though definitions can vary, such as multiyear average or prior-year actual. All of these definitions have an important commonality—they are fixed, nondiscretionary amounts that a new owner cannot subjectively modify.

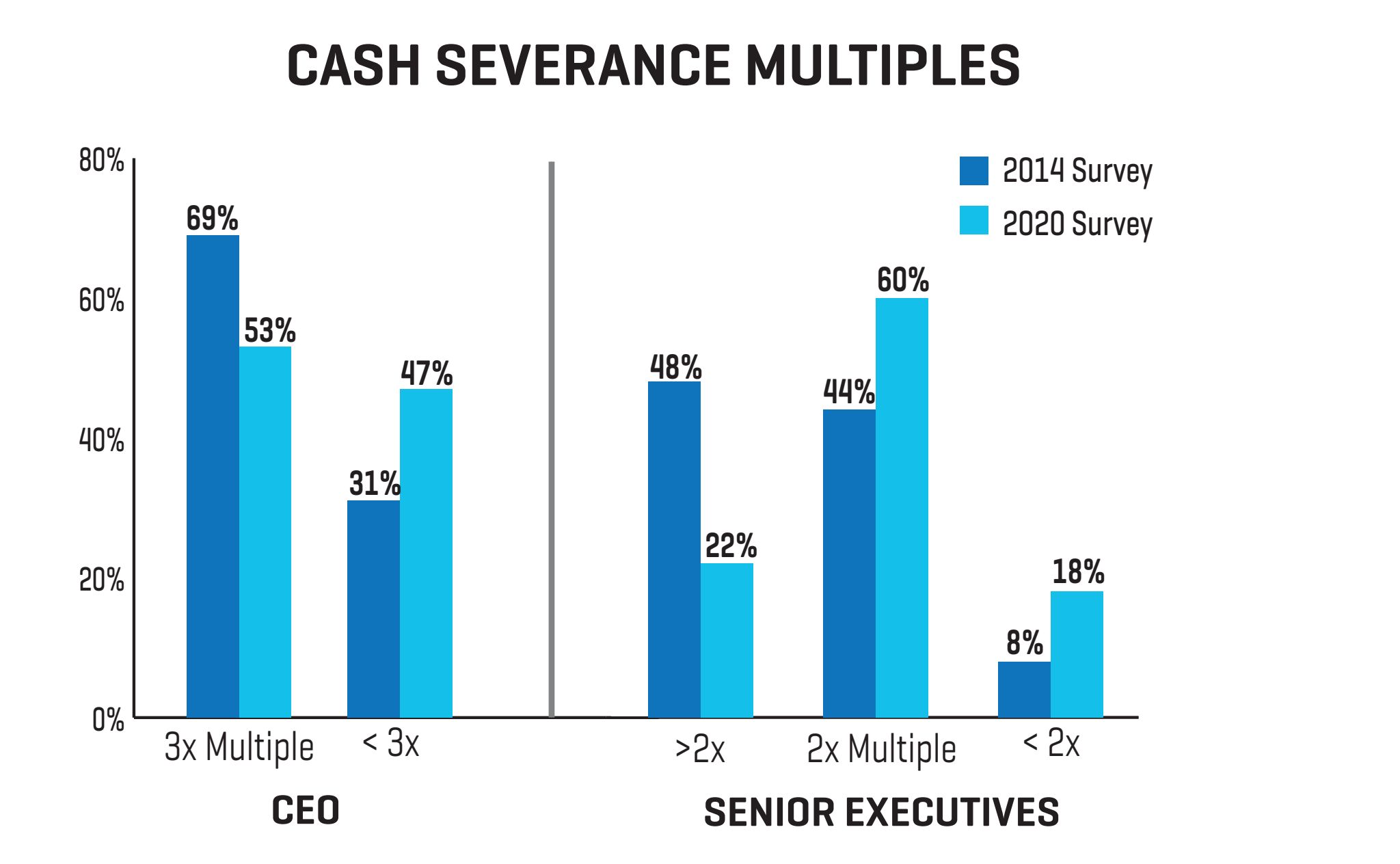

For cash severance, the more notable shift in the market is with the severance multiple. We have seen a material decline in the multiple used for CEOs and other senior executives’ CIC severance. In Meridian’s 2014 study, the CEO cash multiple was predominantly 3× salary and bonus, while senior executives’ multiples were evenly split between 2× and 3×. Our recent study revealed a clear trend toward lower multiples, with nearly one-half of CEO cash multiples below 3× (47 percent) and a great majority of other senior executive multiples at or below 2× (78 percent).

Treatment of Equity Incentives

Regarding the treatment of existing equity incentives, the prevalent practice remains full vesting of all equity awards upon a qualified termination in connection with a CIC event (i.e., “double-trigger”) or if the successor entity fails to assume or replace the award. Where we have identified an emergingtrend is with the definition of performance award payouts. Defining the payout based on “target” performance continues to be most common, but Meridian’s survey found a significant increase in the number of companies defining payout as the greater of target or actual performance (27 percent). This definition enables participants to earn an above-target payout when superior performance is achieved prior to the CIC transaction, assuming performance can be measured mid-cycle.

Restrictive Covenants

One additional area where we have identified evolving market practice relates to the use of restrictive covenants. A majority of companies now include one or more restrictive covenants in CIC arrangements, such as a noncompete covenant. A fairly new concept gaining traction is to allocate a portion of the severance payment as “consideration” for the noncompete, lessening executives’ excise tax exposure.

Excise tax gross-ups have been eliminated from nearly all company severance arrangements, and companies are looking for opportunities to minimize the likelihood of triggering the golden parachute excise tax. Internal Revenue Code section 280G specifically allows companies to exclude consideration for a noncompete from the excise tax calculation, providing a rare opportunity to shield a portion of the severance payments from adverse tax consequences.

Additional market prevalence statistics and insights are included in Meridian’s Executive CIC Severance Arrangements survey, and we encourage companies to consider the changing market landscape when evaluating current severance arrangements. Meridian’s full survey can be found on our website at meridiancp.com.