The question for directors is no longer “What is AI?” but “Can we trust how our company is using it—and will stakeholders trust us when something goes wrong?”

In this immersive workshop, participants will be placed inside a real-world hypothetical scenario where AI-driven decisions trigger unintended consequences. You’ll work in small groups to apply the TRUST framework to assess the situation, identify oversight gaps, and determine the board’s next move.

This is not a presentation. It’s a board governance lab. The scenario will challenge participants to answer:

You will leave with a practical oversight model for AI and data trust you can apply immediately at your next board meeting and a repeatable framework for spotting red flags before they become headlines.

CEO and Founder, Global Data Innovation; Author, Trust: Responsible AI, Innovation, Privacy and Data Leadership

Consistently ranked as one of the most valuable aspects of the Directors Forum, these private, role-based discussions are unstructured by design—and that’s what makes them work. With no formal presentations, and no press in the room, you’ll engage in candid, off-the-record dialogue with fellow directors who understand your challenges firsthand. Participants help shape the agenda in real time, ensuring the conversation focuses on what’s most relevant now. You’ll walk away with fresh insights, practical takeaways, and trusted peers you can call on long after the event ends.

Select the group that best reflects your role or interests:

Leadership forged under pressure builds character—and that’s exactly what boards need today. Herman Bulls, a retired Army Colonel, West Point graduate, and seasoned board director, brings a unique perspective shaped by decades at the intersection of military discipline and corporate governance. In this session, he’ll share examples of how to lead with courage, clarity and conviction under pressure, including:

Vice Chairman, Americas, JLL; Board Member, Fluence Energy, Host Hotels, Comfort Systems USA

Trade wars, military conflicts, and shifting alliances are reshaping entire industries overnight. Directors can no longer treat geopolitical risk as a footnote—it’s become a central variable determining which companies thrive and which get blindsided.

In this session, we’ll examine how leading boards are embedding geopolitical intelligence into strategic planning, from pressure-testing supply chains and stress-testing management assumptions to identifying early warning signals before they hit financial performance. You’ll leave with actionable frameworks for asking sharper questions, guiding management more effectively, and protecting shareholder value when the world shifts beneath your company’s feet.

Leader, U.S. Center for Corporate Governance, BDO

Principal and Leader, Customs & International Trade Services, BDO

Political Economist & Associate Professor, Arizona State University

Principal and Leader, Customs & International Trade Services, BDO

The favorable M&A market and lax regulatory environment have created a rare opportunity for transformational acquisitions. The primary responsibility for strategy and growth may sit with management—but boards are the ones expected to approve the strategy and are held responsible for the outcome.

In this interactive working session, directors will step into the role of a board that is evaluating management’s proposal to make a high-stakes acquisition proposal. As new information unfolds, you and your tablemates will weigh the pros and cons of pursuing the acquisition in real time.

This exercise is designed to sharpen judgment and examine how boards should pressure-test management assumptions when deal tensions escalate. You’ll leave with a clearer framework for exercising oversight when the right answer isn’t obvious—and the cost of getting it wrong is significant.

Co-Chair, Shareholder Activism & Corporate Defense Practice, Sidley Austin

Global Head of Shareholder Engagement and M&A Capital Markets, JP Morgan

Think of this session as a boardroom rehearsal for a moment you hope never comes. Through a fast-moving crisis scenario delivered in stages, you and your tablemates will confront ambiguous information, shifting facts, and intensifying public scrutiny. Working with limited data (just as real boards must), you’ll be asked to make calls, reprioritize, debate trade-offs, and see how your instincts hold up as the situation evolves.

Drawing on PwC’s research with Wharton and the University of Pennsylvania on the neuroscience of decision-making, you’ll experience firsthand how the brain reacts under uncertainty, pressure and social influence—and then compare those reactions with what the science says leads to better outcomes. Through facilitated table discussion, polling, and structured interventions, you’ll practice techniques that improve reflection, attention, and perspective-taking in the boardroom. You’ll learn what gets in the way of good judgment and leave with an applied framework for making smart decisions under pressure.

Principal, PwC’s Governance Insights Center

Director, PwC’s Governance Insights Center

Optional small-group conversations to dive into critical governance topics.

Pricing is one of the most powerful—and least scrutinized—drivers of enterprise value. In this focused breakfast roundtable, directors will examine pricing not as an operational tactic but as a governance issue: How do you evaluate true pricing power versus optimistic assumptions? What signals indicate “quiet erosion” before it shows up in earnings? And what does effective pricing oversight look like in terms of cadence, accountability and guardrails? You’ll leave with sharper questions to bring back to your boardroom—and a clearer lens on pricing as a strategic lever for sustainable growth.

Partner and Board Member, Simon Kutcher

In today’s environment, credibility isn’t assumed—it’s earned, shaped, and amplified. For directors looking to deepen their influence or secure additional board roles, a clearly defined personal brand can serve as a strategic asset. This roundtable will explore how board members can elevate their visibility as subject-matter authorities, communicate their leadership philosophy with clarity, and cultivate trust with stakeholders—from investors to nomination committees. We’ll explore actionable ways to strengthen your professional narrative, build thought leadership in a cluttered space, and ensure your voice stands out as board opportunities evolve.

Publisher, Forbes Books

The dissolving line between physical security and cyber security exposes executives and their families to unprecedented risks, with attacks ranging from doxxing to ransomware and physical harassment. Organizations must bridge gaps between IT and physical security to address this expanding attack surface.

Join this session to discuss:

– Conducting holistic threat assessments across personal and professional domains

– Unifying IT and physical security teams for coordinated protection

– Closing organizational gaps to reduce risk and safeguard executive well-being

Chief Experience Officer, BlackCloak

Cyber incidents rarely escalate because of technology alone. They escalate because of people—unclear accountability, misaligned incentives, leadership missteps, and poor judgment under pressure. In this interactive boardroom scenario, directors will work through a fast-moving cyber event where human and governance decisions determine whether the issue is contained or becomes a broader legal, reputational, and organizational crisis.

Working in small groups, participants will confront the real questions boards face in the moment: when to step in, what to ask, how to guide management, and where oversight failures tend to emerge. The exercise will surface common breakdowns around escalation, internal communication, disclosure, and board–management roles—areas where cyber most often becomes a people problem.

This is not a technical breach drill. It’s a focused governance exercise designed to sharpen board judgment in the moments that matter most. Directors will leave with a clearer understanding of the board’s role in cyber response and practical guidance for strengthening accountability and decision-making before a real incident hits.

Office Managing Shareholder Co-Chair, Privacy and Data Security Practice Group, Littler

Board Member, SEALSQ; MIT Media Lab Fellow (Cybersecurity)

The CEO you choose next may be the single biggest factor in whether your company thrives or just survives. In this interactive session, directors will work through a shared scenario that challenges them to think beyond “ready now” and define what leadership the company truly needs for the next 5 to 10 years. Working in small groups, you’ll discuss the right CEO profile for the decade to come, internal vs. external trade-offs, and what actions the board should be taking now to prepare. A panel of experienced directors and former CEOs will offer insights on how forward-looking boards are making succession planning a strategic advantage—not just a contingency plan.

Managing Director, Pearl Meyer

Board Member, Azenta Life Sciences, Psychemedics Corp. and Akston Biosciences Corp.

You’re facing a proxy campaign questioning whether your board is truly equipped to oversee the company’s future direction. The activist is challenging your board’s composition, governance structure, and ability to drive long-term value in a rapidly changing environment. Working at your tables, you will be asked to evaluate your board’s makeup and respond to key vulnerabilities—whether through refreshing composition, adjusting committees, or strengthening oversight practices. Each group will then defend its approach and hear how other boards would respond differently.

This session will help you:

Are you built to win—or built to be targeted?

Head of M&A and Activism, Americas, FTI Consulting

Partner & Co-Head of Shareholder Activism Practice, Sullivan & Cromwell

It’s easy to focus on shareholder value, quarterly performance, or regulatory compliance—but the decisions made in boardrooms shape so much more: jobs, innovation, trust, reputation, and the future of entire industries. In this closing keynote, we’ll hear from a leader who has seen how purpose-driven leadership at the highest level can transform not just companies, but communities—and why today’s boards must think bigger about the impact they have.

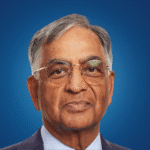

Retired CEO, Rohm and Haas Company; Seasoned director of 15 public company boards including Hewlett Packard, DuPont, Delphi/Aptiv, Tyco and Avantor

Come ready to share challenges, compare oversight strategies and trade lessons with peers navigating similar pressures.

Audit Committee Exchange

From evolving disclosure requirements to AI risk oversight, the audit committee’s scope continues to expand—while expectations around accuracy, ethics, and internal controls have never been higher. This off-the-record session gives audit chairs and members a chance to compare approaches to managing external auditor relationships, cybersecurity readiness, audit committee workloads, internal reporting, and emerging financial risk.

Compensation Committee Exchange

Today’s comp committees are under increasing scrutiny—not only for pay-for-performance alignment, but also for how executive incentives reflect evolving priorities around risk, culture, human capital, and long-term value creation. In this session, compensation committee members and chairs will exchange views on evolving incentive structures, performance metrics, DEI-related targets, shareholder engagement, and how comp intersects with succession planning and CEO evaluation.

Nominating & Governance Committee Exchange

With heightened focus on board composition, refreshment, committee mandates, and ESG-related responsibilities, the nominating & governance committee plays a critical role in shaping long-term board effectiveness. This session offers committee members a private forum to discuss recruitment strategies, onboarding and director education, committee evaluation practices, shareholder expectations, and how to evolve governance practices to stay ahead of risk and disruption.

Chairmen & CEOs Exchange

Whether you’re a non-executive chair, lead director, or sitting CEO, this conversation is for the most senior voices in the boardroom. You’ll engage in a candid peer dialogue around topics like managing the board/management boundary, building trust across leadership transitions, ensuring alignment on strategy and risk, and leading through external pressure—whether from activists, regulators, or the media.

General Counsel Exchange

The GC’s role as board advisor and governance steward has never been more critical—or more complex. In this session, public company GCs will gather to discuss boardroom dynamics, director engagement, disclosure challenges, regulatory developments, and how legal teams are helping boards navigate emerging areas of risk like AI, cyber, and ESG litigation. A private, practical forum to sharpen judgment and compare strategies with those who walk the same tightrope.

Board-Ready Executives Exchange

For executives actively pursuing a public company board seat, this interactive workshop goes beyond resume writing to help you understand what boards are really looking for—and how to position yourself accordingly. You’ll gain candid insights from sitting directors and boardroom decision-makers, explore how to apply a director’s mindset to governance challenges, and refine your board value proposition and bio with peer feedback. Leave with greater clarity, confidence, and a sharper strategy for landing the right board opportunity.