The 2023 planning season is upon us, and with it, a concerning level of uncertainty around what the new year will bring. Inflation, supply chain issues, recession concerns, geopolitical tension, stock market turbulence and other disruptive forces are all converging to create a challenging planning environment for today’s compensation committees.

“The economic backdrop changed significantly from the start of the year as we progressed through 2022, and that continues to be an area of focus as companies start their compensation planning for 2023,” notes Lou Taormina, a managing director at FW Cook. “Thinking through both how to approach setting goals and how to incorporate equity compensation into incentive programs will be challenging in the current environment.”

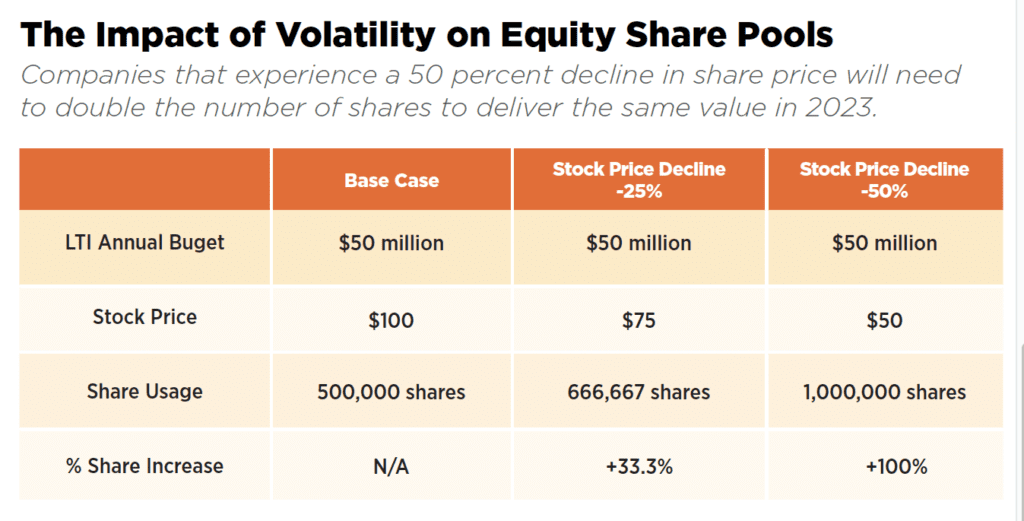

Stock market gyrations are a particular concern for today’s compensation committee members, many of whom are raising questions about the sustainability of their equity grant methodology in a more volatile market. Most companies use a value-based approach for determining grants, setting an award value and determining the number of shares based on share prices around the time of the grant date. However, this approach may be challenging in turbulent markets where a grant date may coincide with a material decline in share price, triggering a dramatic increase in the number of shares being granted to get to the award’s designated dollar value.

Adapting to Volatility

Thus far, the impact of recent market dips on burn rate has varied widely by industry, with the tech and life sciences sectors among the more deeply affected, notes Rachel Chiu, a principal at FW Cook, who expects a greater number of companies to be forced to pursue share replenishments in 2023 as a result. “The trend has been for companies to keep their equity grant values the same, which means granting more shares and burning through reserves more quickly than expected,” she says. “However, for companies already sitting on high dilution, going back to shareholders for more shares is time-consuming, costly and may not be palatable.”

At the same time, guarding a limited stock pool by making adjustments that result in lower grant values can be equally problematic. Overall, competition for talent has loosened only slightly since the economic downturn, and skilled workers remain in demand, particularly in the tech and science fields.

“As much as we’ve seen some slowing of hiring and even layoff announcements, many companies are still encountering increased turnover and challenges filling open roles,” says Taormina. “So they’re really struggling to figure out, how do we get through this volatile market with a limited share pool to work with? How will we balance the need to offer incentives that keep top talent on board, motivated and focused during challenging times with the responsibility to manage the dilutive aspects of burning through more shares?”

Considering how different scenarios will play out from a compensation standpoint is a good first step for companies facing the prospect of market volatility. Looking at the impact on the company’s long-term incentive budget and share usage that various levels of stock price decline would have can help determine if compensation plan adjustments are warranted.

While there is no silver bullet to granting equity in a volatile market, techniques exist to help mitigate the effects of market swings on dilution. For example, compensation committees concerned that adhering to the traditional market-value methodology will bring an unacceptable level of dilution may want to consider adopting a price averaging approach that bases the amount of shares to be granted on a trailing average price of the stock. Using a trailing average rather than the value on a specified date smooths out the impact of volatility. While companies typically use a 30- to 60-day timeframe for price averaging, Chiu has seen the range climb to 90 days in the current environment.

Another, more extreme approach is to set a floor below which the stock price value used to determine the grant amount will not fall, regardless of market value. “Basically, no matter how low the stock drops, you’ll just be using that minimum price to determine the number of shares to be granted,” explains Taormina. “You’re essentially cutting the grant amount, which has retention risks but is something companies may want to do in situations where tracking the price all the way down would create an unacceptable level of dilution in a given year.”

Finally, some companies choose to revert to a price used for a prior grant date made during less volatile times in order to guard against volatility and manage burn rates. It is worth noting that values in proxy tables require grant date fair value, so with these approaches proxy table grant values will not align with the actual values granted. “That can create a disconnect with recipients because you may tell someone what their grant is worth from an accounting standpoint and then on the day of the grant it may be very different,” warns Chiu.

Buying Burn Time

While it’s generally uncommon for companies to deplete their share reserves prior to an upcoming grant, recent volatility suggests that compensation committees should be mindful of that possibility when establishing a long-term incentive budget and equity mix for 2023. Should there be a substantial reset of a company’s stock price, a share pool intended to last three to five years might well disappear more quickly, forcing a company to “buy time” to gain shareholder approval for a stock replenishment.

Faced with such a scenario, companies have several alternatives to help manage their equity share reserves:

• Reducing or Reallocating LTI Budget Dollars: An across-the-board reduction of grant amounts can help stave off a depletion, however retention rates may suffer. “Another route some companies are taking is to increase the differentiation in award amounts to focus on retaining key performers,” says Chiu. “Or to cut back on the percentage of people in the organization who receive grants in order, again, to focus on retaining key players. In good times, the inclination is to share more and go deeper in an organization, but in times of struggle, companies may need to be more selective.”

• Partial/Staggered Grants: Bestowing a portion of the grant now with the remainder to be granted after shareholder approval of the replenishment program can also help manage faster-than-expected burn rates. “If the market really deteriorates to the point where you’ll run out of shares in advance of the annual shareholder meeting, you can model a partial-grant solution where you provide a portion of the grants on schedule and the remainder once approval of the new share reserve is obtained,” says Taormina. “Some companies choose to keep a subsector whole, typically non-executive officers, with only the senior executives waiting for share replenishment.”

• Cash-Settled Grants: Switching to a cashbased payout on a temporary basis can alleviate the need to pull from a share pool, and still be structured to retain the tie to shareholder performance. “With a cash-settled grant, you still track the stock price over the performance period, but instead of giving the recipient shares at the end, they receive the cash equivalent,” explains Taormina. “You’ll put pressure on your cash situation, and there are accounting aspects that make this alternative less desirable, but it’s an option in a situation that requires preservation of shares.”

• Promise of Future Grants/Contingent Grants: In extreme situations, companies facing a share pool shortfall due to a material stock price drop may delay their annual equity grant cycle, committing instead to issuing the grant post-shareholder approval. “Let’s say your grant cycle is in March and you don’t have enough share reserves to get through a March grant cycle, but your shareholder meeting isn’t until June,” explains Chiu. “You would switch to contingent awards where you give maybe half of what was promised with the remainder coming in June, contingent on shareholder approval.”

• Inducement Awards for New Hires: Stock exchanges allow companies to use an inducement plan to bestow equity to new hires without deducting those shares from their shareholder-approved grant reserve pools. “Inducement awards will still count toward burn rate, but since they are coming from a different, non-shareholder approved plan, it will allow your current equity share reserve to last longer,” explains Chiu. “Used judiciously, they can be quite valuable in terms of being able to attract the talent the company needs without putting pressure on the share reserve.”

Modeling For Movement

While these tactics can help manage burn rate pressure, ideally companies should take a proactive approach in planning for the likelihood of greater market volatility in the coming year. Modeling the impact of stock price movement on share reserves can help manage a situation where a substantial reset in the stock price puts the company in jeopardy of depleting its share pool prematurely.

“As we head into LTI planning for 2023, the focus should be on thinking through different scenarios as to where the stock price may be at the time of the grant to understand the impact on the share reserve,” says Taormina. “And then whether that increase in the burn rate is something the company can endure, or, if not, what actions should be taken? Ultimately, the key is to avoid any unwelcome surprises.”