The Board’s DEI Dilemma

With informers and subpoenas, the Trump administration wants to root out preferences of any kind.

With informers and subpoenas, the Trump administration wants to root out preferences of any kind.

A candid discussion on our current AI moment and what boards need to do to meet it. “We might only have one shot to get this right, so let’s do that now.”

A new survey of general counsel, chief compliance officers and audit leaders finds business risk on the rise in the third quarter, amid turbulent regulatory environment and tariff impact.

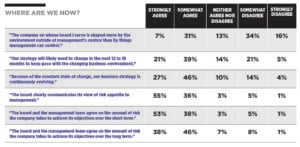

Overseeing a company’s resilience and adaptability in today’s disruption-driven landscape is no easy feat. To gain insights on how boards oversee these intangibles, balance risk with opportunity and help their leadership teams see around corners, Corporate Board Member partnered with EY to survey nearly 200 public company board members. Some takeaways.

The technology is subject to the same echo chamber ills as groupthink.

As disruption continues to reshape strategy, directors seek more risk-taking from their management teams, new survey finds.

A targeted strategy can help ensure your proxy vote passes without problems.

These five design elements help ensure CIC arrangements align executives with shareholder interests during transactions.

of directors are prioritizing growth opportunities in 2025, a sharp turnaround from the past few years’ focus on cost-cutting measures.

Every year, Corporate Board Member surveys U.S. public company board members to take their pulse on the issues that are most prominent in the boardroom for the year to come. View Insights>