Overwhelmingly, the consensus among 192 directors of public companies CBM and EY recently surveyed about what it takes to navigate our modern era of disruption is the ability to balance strategic risk taking—necessary to foster innovation and continuous growth—and reasonable risk mitigation—required to preserve the company’s advantage and market share along the way. “We’re working in a very dynamic market,” says Kathy Hannan, who serves on multiple boards, including Otis Worldwide Corporation, Annaly Capital Management and Gingko Bioworks. “But risk management and innovation are not mutually exclusive.”

Intellectual curiosity and “learning to be comfortable with complexity and change” are key in steering a corporation in such an environment, she says, noting that both risks and opportunities arise from disruption, and companies need to be adept at identifying them. “You can’t control the craziness, but you do have to be well educated and informed, resilient, nimble—all those things that sound so nice but are very real. Because if we’re educated, we’re able to connect the dots, able to see the patterns in the data, to ask the right questions.”

“With the level of disruption businesses are experiencing in virtually every sector, these qualities are more important than ever for board members to consider when carrying out their essential responsibilities,” agrees Robyn Bew, director at EY Americas Center for Board Matters and a partner in CBM’s board research for the past six years.

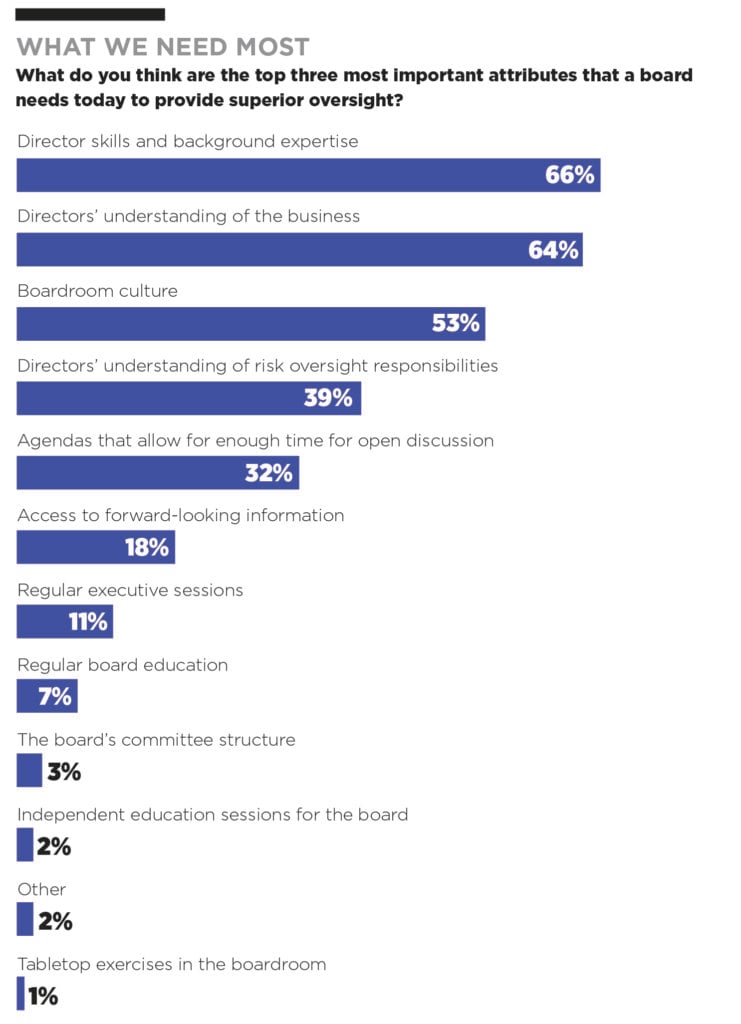

In ranking the attributes that best equip a board for oversight in this dynamic market, 66 percent of participants cited “skills and background expertise” as among the three most important, followed by “an understanding of the business” (64 percent) and “the right boardroom culture” (53 percent). Seen as less key were learning opportunities, with just 7 percent of respondents rating board education as a top three attribute and even fewer citing independent education (2 percent) or tabletop exercises (1 percent).

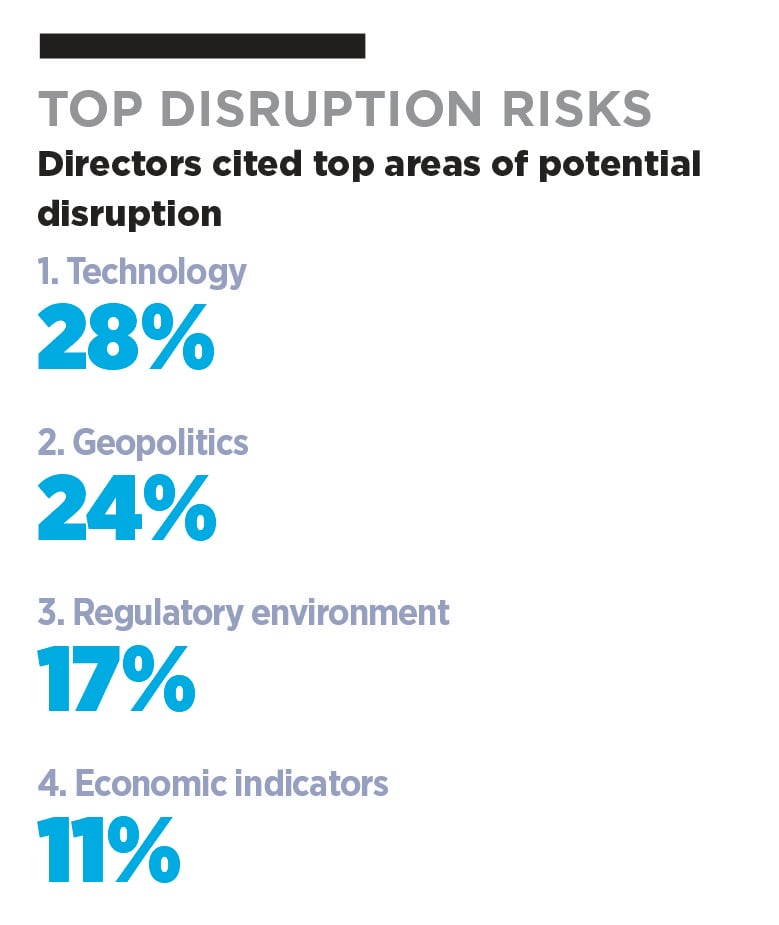

SOURCES OF DISRUPTION

Technology (28 percent) and geopolitics (24 percent) topped the list of sources of disruption that concern board members most, with AI called out specifically by 82 percent of those who listed technology as a concern. Michael Smith, lead independent director of the Zebra Technologies board, is among the board members concerned that companies aren’t moving fast enough and are under-investing in understanding “the profundity of change to their business models that AI may harbor.”

“I worry that companies are not immersing themselves in learning deeply enough to intelligently ascertain if there’s a profound strategic threat,” he says, noting that highly profitable companies that are clear leaders in their industries are vulnerable to digital native upstarts. “Yet, their AI deployments are highly operational, not strategic, highly focused on sort of incremental efficiencies where over time you hope to save 20, 30 percent. Those companies are just ripe fat targets for digital disruption and AI disruption that will threaten their business models.”

Jeff Dailey, a former CEO of Farmers Insurance who is now on the board of Liberty Mutual and publicly traded Verisk Analytics, has seen that firsthand in the insurance industry, where data tools upended not the product but the delivery model, sending traditional insurance models in a frenzy. “Think about insurance 20, 30 years ago, people tended to go to an agent they trusted or their parents trusted, and they got whoever [insurer] that agent put them with. Geico and Progressive really changed that, developing brands that consumers could trust in. They pushed the business toward more of a commodity focus because if you look at most of the advertising, it’s really focused on getting people a lower price for the same thing.”

Dailey says AI is setting up a similar but more powerful wave of disruption. “It’s probably going to give an opportunity for the right companies to get themselves on an equal footing as some of the companies that have had a real stranglehold [in their sector],” he says, adding that agentic AI carries potential to be the next big disruptor. “A Wharton School business professor came in and talked to one of the boards I’m on last week. His point was, the AI [agent] is probably going to be 92 percent accurate. People are probably 85 percent accurate. That’s the kind of stuff I think that using AI in the insurance industry, or even as a selling tool, will affect the retail side pretty quickly.”

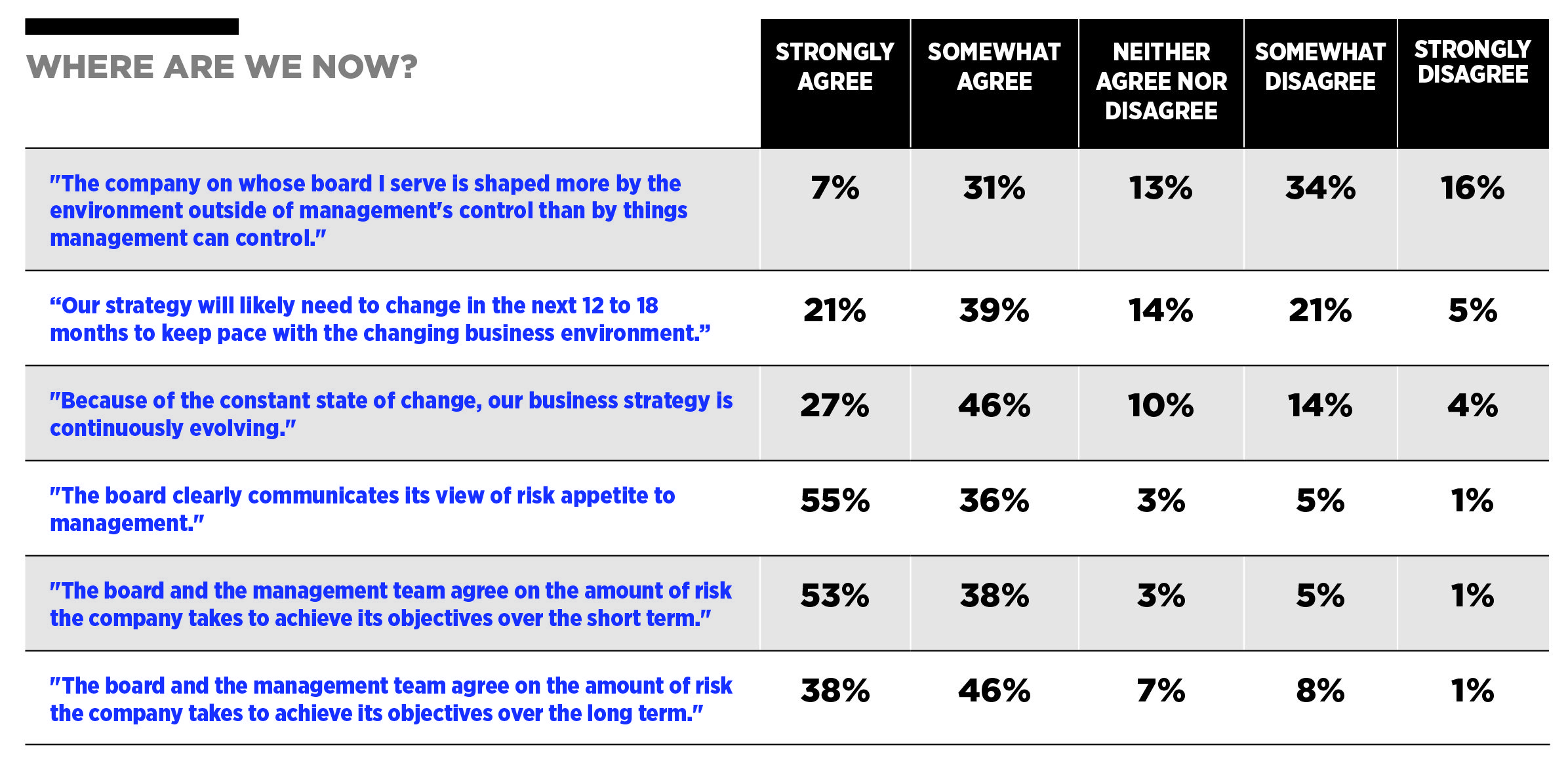

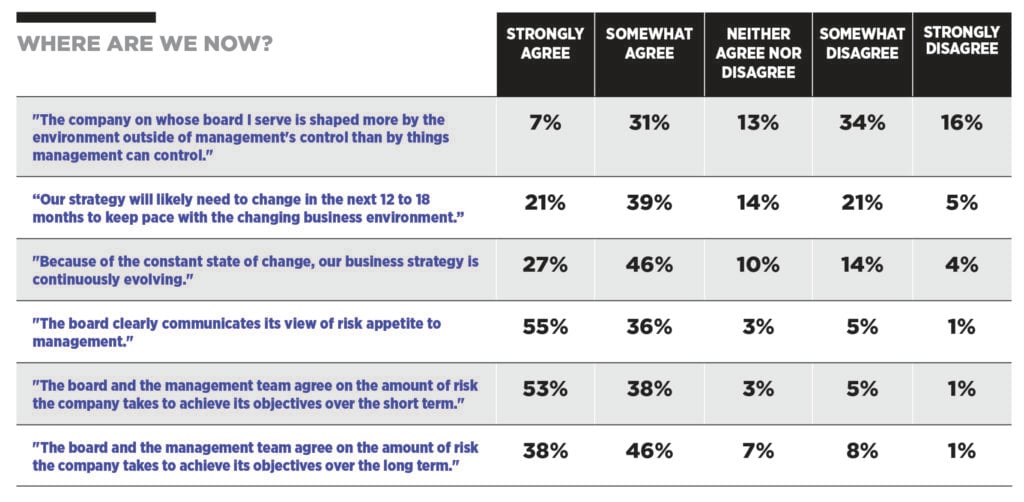

FINDING ALIGNMENT

Effective oversight of innovation and the threat of disruption demands boards and management team alignment on an appropriate risk-growth balance, agreed survey participants. Nine out of 10 directors said their board clearly communicates its view of risk appetite to management—and the same proportion said management and the board agree on the amount of risk the company should take to achieve its objectives over the short term. That proportion dips slightly, to 81 percent, when discussing the long-term risk-taking strategy. Overall, however, survey participants see strong alignment between boards and management on the level of risk to take to achieve goals.

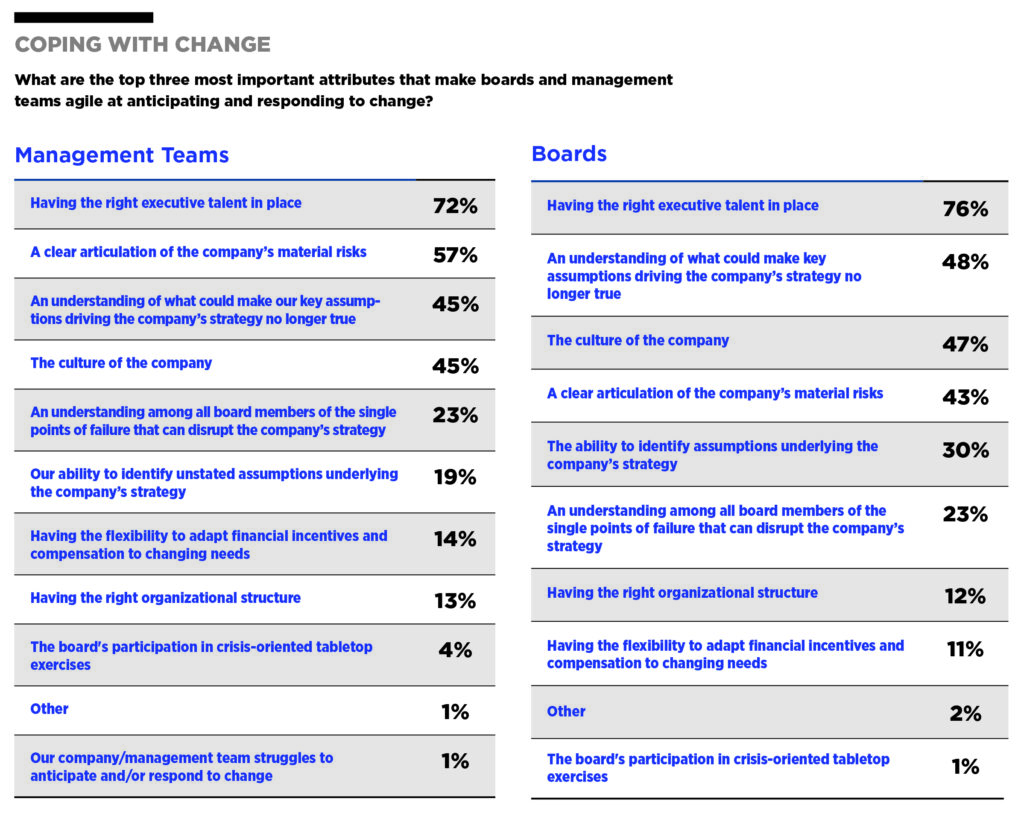

Asked what attributes management teams need to be agile at anticipating and responding to change, most directors cited “having the right executive team in place” (72 percent), “a clear articulation of the company’s material risks” (57 percent) and “an understanding of what could make our key assumptions driving the company’s strategy no longer true” and “the culture of the company,” both at 45 percent.

On the board side, 76 percent of directors selected “having the right executive team in place” as the most critical attribute necessary to anticipating and responding to change. “An understanding of what could make key assumptions driving the company’s strategy no longer true” ranked second most important (48 percent), followed by “the culture of the company” (47 percent).

“Culture sets the tone for risk, sets the tone for collaboration, sets the tone for innovation,” says Barbara Adachi, who serves on the board of Old Republic International as well as two private company boards, “You need to trust that management’s not going to do anything crazy, that they’re not going to jump off the deep end and put anything major at risk for the company [but also] trust them to try new things, to take risks, even if those don’t pan out.”

Adachi points to innovation giant Amazon’s “failure as a success” philosophy as an example, noting that companies on whose boards she serves have taken a similar approach in introducing new products. Despite ultimately being killed, the attempts weren’t deemed failures. “Because if we didn’t try, then we wouldn’t have known, “Could we have taken some market share?” she says.

Those bets need to be strategic, she cautions. “First, determine who you are and where are you going? Are you the innovator, or are you the fast follower? What’s your position, what’s your differentiator? Is technology going to be a differentiator for you as an organization, or is it going to be a disruptor? Make those decisions first, so you don’t get distracted by every little thing that’s coming out there. Because if you put your own strategy in jeopardy, you won’t be out there doing what you need to be doing.”

Such risks may be a necessity today. “Being a ‘fast follower of the right thing’ was an okay strategy in the past, but I’m not sure that’s true anymore,” says Dailey, who says that as CEO of Farmers and Bristol West he sought to bring diverse viewpoints into the boardroom to gain different perspectives on risks and opportunities.

Today, he brings that same philosophy to his boards. “Our value is to get the management teams to be thinking about other things—not to tell them what to do but to actually say, ‘In my experience, I’ve seen X, Y and Z, and you should think about how it applies to your business and what, if anything, you should do about it,’” he says. “The board is not doing its job if it’s not challenging management. You have to make sure [management] really has the conviction that what they’re doing is right and well founded. Because if you go in the wrong direction or don’t go in a direction that it’s pretty obvious the rest of the world’s going into, it puts the company at risk.”

In some cases, that may mean challenging who occupies the top office. “If the board really thinks the company is on the wrong path,” Dailey says, “the single most important thing a board does is say, ‘You know, we’ve bet on the wrong horse, and we think this horse is going to lose the race. We’ve got to pick a new horse.’

“Even the best management teams and boards won’t get it 100 percent correct,” Dailey adds, “but if you’re good at it, you’ll get pretty close to the right direction. And trying to figure out what’s going to happen over the next two years, let alone five or 10—I don’t know who’s got a good crystal ball on that.”