In a recent survey of nearly 100 public company CEOs and board members, conducted by Corporate Board Member in partnership with the Long-Term Stock Exchange, we uncovered a striking pattern: Companies committed to long-term strategies demonstrate measurably greater confidence and resilience when navigating economic uncertainty.

While the research series revealed the broad challenges facing public companies today, a deeper analysis, using the proprietary scoring model of the Long-Term Stock Exchange, an SEC-approved exchange focused on long-term value creation, reveals how companies with stronger long-term alignment approach these same pressures fundamentally differently.

The Long-Term Advantage in Numbers

Our analysis separated survey respondents into two groups based on their companies’ LTSE Long-Term Company Ratingsm—a model that evaluates 16 signals from third-party evaluations and direct company behaviors related to a long-term focus around strategy and stakeholders. Companies are scored on a scale of 0-100, with only 10-15 percent of publicly traded companies achieving moderate to high scores. The results were illuminating.

When asked to rate their confidence in remaining competitive over the next 3-5 years, leaders from companies with a moderate to high LTSE Long-Term Company Ratingsm averaged 7.3 out of 10 compared to just 6.7 for those with low scores. This difference represents a 9 percent confidence premium that translates into materially different strategic decision-making.

One CEO from a high-scoring company expressed confidence in their strategic position, citing a strong five-year vision. However, they rated their confidence at 8 out of 10, explaining: “AI and IT innovation [create] the potential for unexpected competitive disruption, making future market dynamics difficult to predict.”

This response stands in stark contrast to that of a board member at a low-scoring company: “[It] all depends on our ability to get financing. Given the portfolio, I would have been much more optimistic, but given the market and geopolitical uncertainty, the best I can do is a 5.”

Different Pressures, Different Priorities

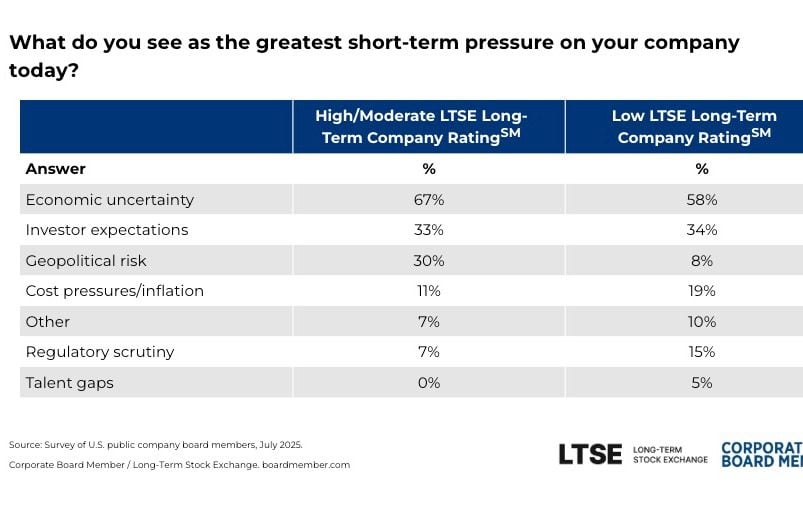

The survey revealed that while economic uncertainty affects all companies, long-term focused organizations identify and prioritize risks differently. Companies with a moderate to high LTSE Long-Term Company Ratingsm were more than three times as likely to cite geopolitical risk as a top concern (30 percent vs. 8 percent, suggesting a more sophisticated understanding of systemic threats that could impact their extended strategic horizons.

Meanwhile, companies with low long-term alignment were more focused on immediate operational pressures, with 19 percent citing cost pressures and inflation compared to just 11 percent of their long-term focused counterparts.

This difference in risk perception extends to how these companies view threats to their strategic priorities. Long-term aligned companies were more likely to worry about capital investment (41 percent vs. 29 percent) and innovation and R&D (33 percent vs. 21 percent) being at risk, while companies with lower long-term alignment were equally concerned about capital investment and market expansion—a shorter-term growth strategy.

As Jim McKelvey, co-founder of Square and author of The Innovation Stack, shared with us after reviewing the results: “The best time to innovate is when chaos has paralyzed the competition. Jack [Dorsey] and I launched Square in the midst of the 2009 recession and had our pick of talent and empty office space. It’s a pattern: Stuff happens and people freeze, but the few who don’t create the future.”

As we’ve learned from 50 years of research by academics, policymakers and global business leaders, there’s a framework of five principles that lead to long-term value creation. These principles include focusing on a broad set of stakeholders, prioritizing long-term strategy, aligning executive and board compensation with long-term success, defining explicit board oversight responsibilities, and encouraging engagement with long-term investors. These principles work together to promote resilience and systemic change.

Strategic Responses That Set Leaders Apart

Perhaps most tellingly, long-term focused companies approach uncertainty with different strategic tools. Companies with moderate to high LTSE Long-Term Company Ratingsm were significantly more likely to enhance scenario planning (48 percent vs. 29 percent) and adjust capital allocation (24 percent vs 16 percent).

Meanwhile, companies with low alignment were five times more likely to prioritize strengthening communications with investors (20 percent vs 4 percent)—representing the second-largest difference between the two groups.

This striking disparity may reflect a fundamental difference in investor relationships. Companies committed to long-term strategy typically cultivate ongoing engagement with investors who share their time horizons, reducing the need for reactive communication during periods of volatility. In contrast, companies without this foundation may find themselves needing to work harder to maintain investor confidence when uncertainty strikes.

The advice from leaders at long-term-focused companies reflects this philosophical difference. “Don’t let the short-term demands overtake the more important, strategic, and mid- to long-term investments and focus,” advised one board member from a high-scoring company. Another CEO emphasized: “Long term has to be the #1 priority—make sure a disproportionate amount of your time is focused there.”

The Framework for Resilience

Making the right decisions for long-term value creation can be challenging, but companies that have been clear about how they define success— and their strategy to achieve it— are better positioned to get the credit they deserve for durable value accretion. The most resilient companies maintain a consistent, clearly articulated long-term focus where boards, executives, investors and employees are aligned on core values and vision for the future.

As Carol Geremia, president of MFS & co-head of Global Distribution, noted in a whitepaper released this year: “When public companies align their investor capital with their long-term strategies, it can have a meaningful impact on their long-term financial results. This alignment can lead to higher return on invested capital (ROIC), higher allocation to research and development (R&D) and capital expenditure (CapEx), and a reduced demand for short-term guidance or estimates.”

As CEOs and board members, we absolutely have to deliver on short-term metrics. Both our customers and investors depend on it. But the key is ensuring those short-term targets are deliberately designed as mile markers on the path to long-term value creation. When you can clearly articulate how this quarter’s performance connects to your five-year vision, you’re creating a stronger, more meaningful narrative that demonstrates intentional progress toward sustainable growth.

The data from our survey substantiates what many of us have witnessed firsthand: companies that embed long-term thinking into their governance structures, strategic planning, and operational decision-making don’t just survive periods of uncertainty—they use them as opportunities to strengthen their competitive position while others are distracted by short-term volatility.

In times like these, the companies that will emerge stronger are those that resist the temptation to sacrifice their future for immediate relief. They understand that true resilience comes not from avoiding uncertainty but from building the strategic foundations that allow them to navigate that uncertainty successfully while staying true to their long-term vision.

About the LTSE

LTSE is an SEC-approved exchange designed exclusively for companies committed to long-term strategies and strong governance. Those companies prioritize sustainable value creation over short-term reactions to market challenges. To learn more, visit ltse.com.