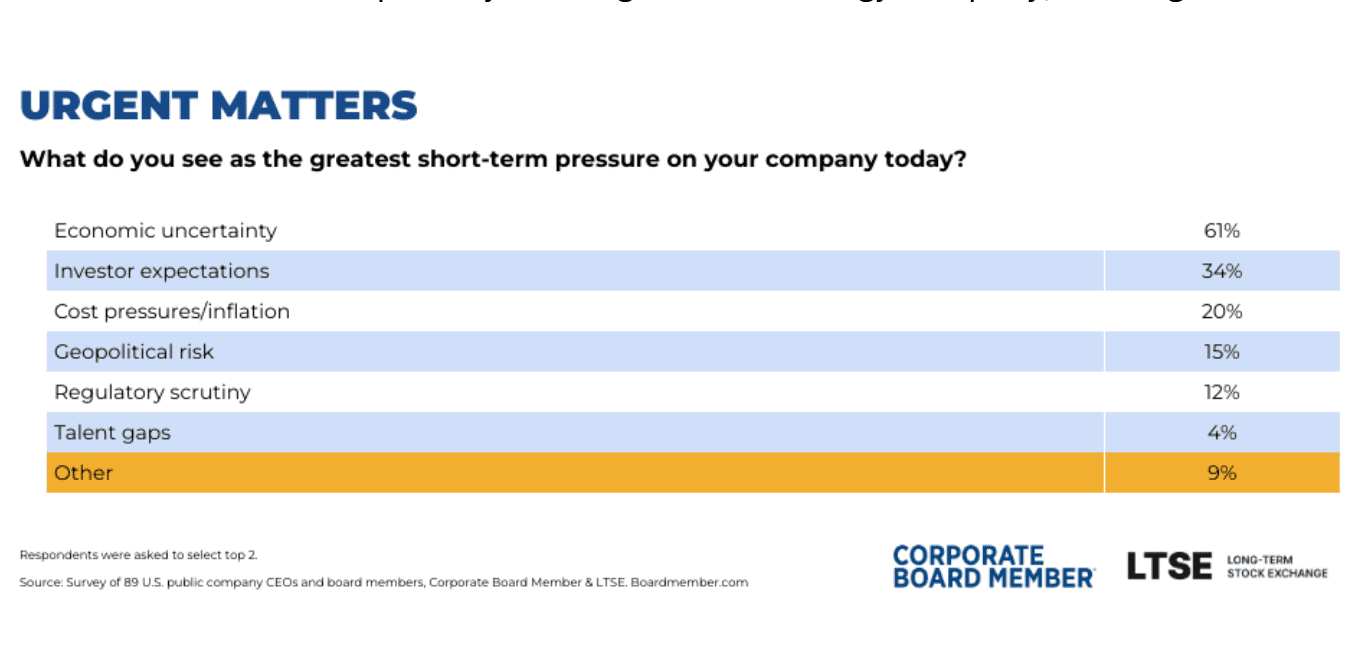

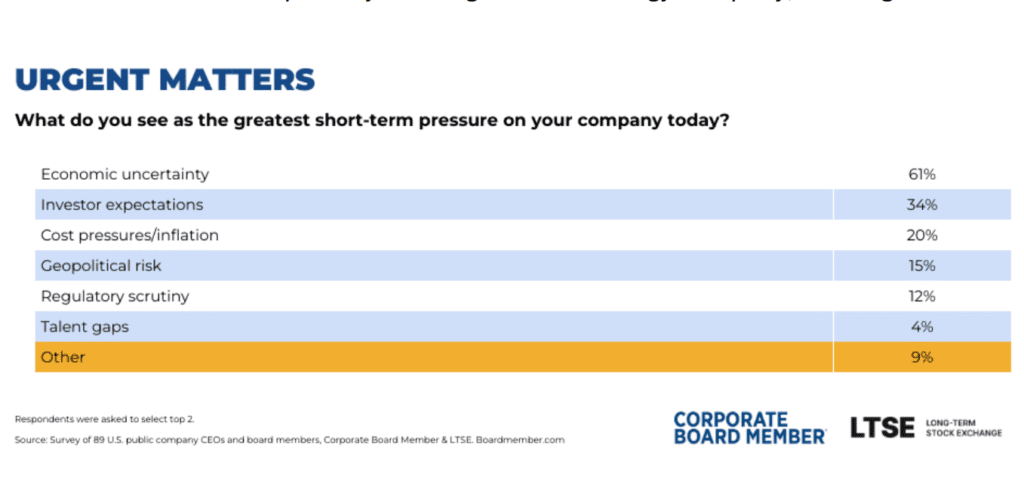

The economic uncertainty brought about by evolving tariff considerations has had a well-documented impact on many companies’ ability to forecast and plan this year. But a new survey by Corporate Board Member and Long-Term Stock Exchange finds those short-term pressures may have a far-more lasting impact on public companies than many realize.

The survey, of nearly 100 public company CEOs and board members conducted in early July, finds 61 percent of America’s business leaders citing economic uncertainty as their top short-term challenge today—nearly 30 points higher than the second-ranked challenge— with many pointing specifically to the lack of guidance on tariffs and how these trade negotiations will eventually play out for the U.S. economy.

As a result, CEOs and directors participating in the survey said they are struggling to plan for even just two to three years out and are pulling back on investments. Among the long-term strategies most at risk, according to the survey, capital investment (33 percent), innovation and R&D (25 percent) and market expansion (24 percent) round out the top three.

“Trade wars are causing companies/customers to delay investment plans, raising costs and reducing demand, which could lead to a global economic depression,” said the CEO and executive chair of a publicly traded global technology company, echoing others.

Maliz Beams, CEO of the Long-Term Stock Exchange and chair of the LTSE Group Board, our partner in this research, says the survey results are a red flag. “As CEOs, we absolutely have to deliver on short-term metrics; both our customers and investors depend on it. But the key is including short-term targets deliberately designed as mile markers on the path to long-term value creation,” she said.

“When you can clearly articulate how this quarter’s performance connects to your five-year vision, you’re creating a stronger, more meaningful narrative that demonstrates intentional progress toward sustainable growth.”

Chris Perry, president of Broadridge Financial and a member of the board of Verisk Analytics, agrees: “Don’t sacrifice your R&D budgets due to short-term volatility or constraints. Get more efficient or stop doing something and decide what through a short and simple evaluation process. You’re doing too many things,” he said.

Others also offered advice to those struggling with their long-term strategy, including bolstering up the balance sheet and cost structure in a way that ensures the company can sustain short-term bumps without sacrificing long-term development.

“Don’t make short-term moves that hurt long term strategies,” one CEO said. Flexibility and agility are important, of course, but “make sure you adapt within the boundaries of your long-term goals/strategy.”

Fully one third of respondents said their company is adjusting capital allocation to navigate short-term volatility, and 31 percent said they are conducting more scenario planning as part of the process.

Still, despite these efforts, the level of uncertainty has public company CEOs and boards feeling uncertain about their companies’ ability to compete over the next 3 to 5 years. They rate that ability at 6.9 out of 10, on a scale where 1 is not at all confident and 10 is extremely confident—not a devastating grade but not great either considering what’s at stake.

One CEO noted the lack of confidence is entirely caused by external factors. “All depends on ability to get financing,” he said. “Given [our] portfolio, I would have been much more optimistic, but given the market and geopolitical uncertainty, the best I can do is a 5.”

Michelle Greene, president emeritus and board member of the Long-Term Stock Exchange, and former Interim CEO, says this is why it is critical to keep long-term strategy top of mind. “Making the right decisions for long-term value creation can be challenging, but companies that have been clear about how they define long-term success and their strategy to achieve it are better aligned to get the credit they deserve for durable value accretion.”

Overall, most CEOs and directors participating in the survey agreed long-term thinking must remain the priority, even if it’s a struggle. “Make sure a disproportionate amount of your time is focused there,” said the CEO and executive chair of a large publicly traded company.

And don’t get distracted by short-term issues, added Alice Huang, who serves on the board of Regulus Therapeutics: “Keep an eye on your long-term goals and core values.”