M&A activity has bounced back from its pandemic-related trough, and forecasts of unprecedented growth and opportunities in a post-Covid world are projected to fuel numerous more deals as we progress further into the year.

It has been nearly a year since the Covid-19 virus was reported on U.S. soil, and much ink has been spilled about how it has affected businesses across the country. In recent weeks, however, with the U.S. beginning to deliver vaccines, the focus has shifted from cost control to growth opportunities.

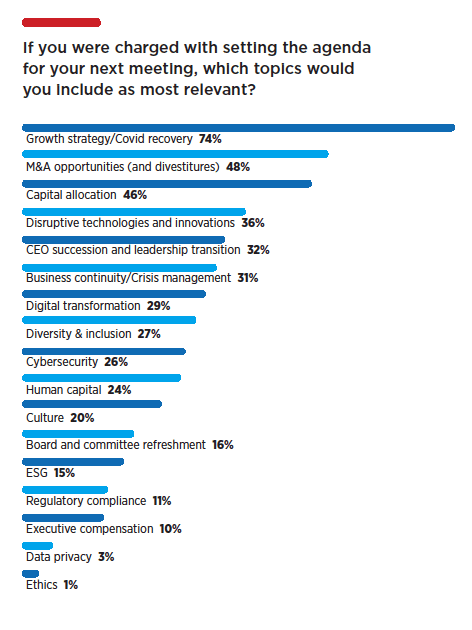

After a notable drop in M&A activity through the thick of the crisis in 2020, survey data shows that the conversation has now resumed: While only 32 percent of directors surveyed in the summer of 2020 reported pursuing M&A opportunities created by declining valuations, just a few months later, 48 percent said they now wished their board would refocus on growth and allot more time to discuss M&A at the next meeting.

“There were concerns early on about liquidity and companies, and no one knew how bad it was going to get or what the full fallout from the pandemic was going to be,” says Howard Lance, former CEO of Maxar Technologies and non-executive chairman at Change Healthcare and Summit Materials, adding “It’s not like we have all the answers, but I think every company knows a little more about the impact. People are just feeling more informed about the range of potential impact and are adjusting their plans accordingly.”

The prospect of transitioning to a new administration is also fueling deal-making. “There is a bit of a rush to sell right now because general evaluations are high and potential sellers are concerned what the tax environment is going to look like,” says Mike Losh, the former CFO of General Motors and audit chair at both Aon and Cardinal Health. “I think things went on a bit of a hiatus, particularly from a buyer’s standpoint, wondering how this business is going to perform in this environment. But that’s kind of sorted out at this point: the financial situation, the ability to finance is again good, you can issue debt, you can borrow debt from banks, there’s an impetus to sell, so I think you’ll see quite a bit of activity in the near term.”

Uncertainty remains, though: Will the vaccine successfully eradicate the threat of the coronavirus? When will businesses be able to return to full operations? How long will it take for consumers to return with confidence? What will be the total cost of this pandemic on the world? How will this crisis change the way we conduct ourselves and business in general? All those, and many more, are questions that have yet to be answered.

“You have to make the assumption that, as a country, public health-wise, we’re not out of the woods yet,” says Lance. “Everyone now is coming to believe that with a vaccine or not, this is a multiyear event. It’s not going to go away the second there’s a vaccine…And I think you’re much better off assuming it’s going to be around in one form or another for an extended period of time and trying to adapt to that.”

For more insights from directors participating in our study, download your complimentary copy of the 2021 What Directors Think Research Report >>