In the ever-evolving landscape of compensation plan design, severance pay practices sometimes get short shrift. Understandably, compensation committees tend to prioritize areas like short- and long-term incentive pay when scrutinizing pay practices for the employees they hope to recruit, retain and incentivize. Yet, establishing and maintaining a well-structured severance pay program also plays a crucial part in each of those areas.

A formal severance pay program can be a useful tool for companies recruiting during a volatile economy or those operating within industries in which layoffs are prevalent, providing reassurance to prospective candidates. Having job-loss protection in place also helps ensure that executives act in the best interest of their company’s shareholders when M&A opportunities arise, says Cimi Silverberg, a managing director at FW Cook. “Companies don’t want executives disincentivized to explore a transaction because it might result in the loss of employment,” she explains. “A change-in-control (CIC) plan guards against that by providing a bridge until they find another job.”

CIC SEVERANCE PRACTICES

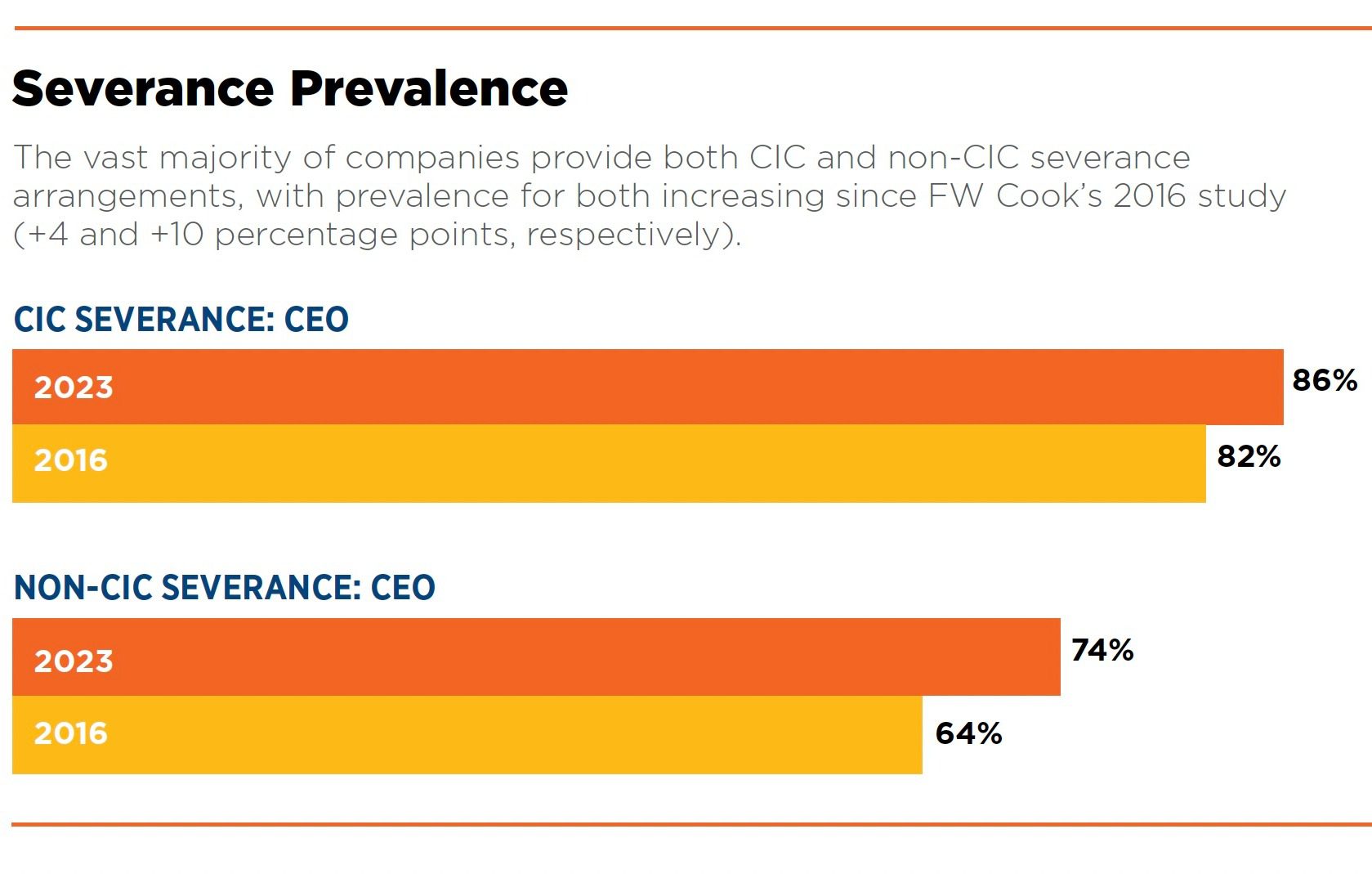

All of these reasons factor into relatively widespread adoption of CIC severance programs, adds Tamar Garoon, a consultant at FW Cook and author of the company’s 2023 Executive CIC and Non-CIC Severance Practices report, which examined current market severance practices at 210 companies. “At 86 percent of companies for CEOs and 85 percent for CFOs, prevalence is relatively high,” she says, explaining that the report looked at data for the two positions— CEO and CFO—for which companies must publicly report compensation. “CEO stands alone, and we look at the CFO practices as essentially being representative of severance pay practices for all other NEOs.”

This year’s report indicated a few changes in CIC severance pay practices since FW Cook’s previous severance study in 2016, including a shift toward plans designed to cover multiple employees rather than individual executive agreements. CIC plans covering multiple employees increased from 39 percent to 48 percent for CEOs and 48 percent to 59 percent for CFOs between 2016 and 2023, whereas prevalence of individual executive agreements decreased from 43 percent to 38 percent for CEOs and from 33 percent to 26 percent for CFOs. That shift reflects growing acknowledgement of the benefit of establishing severance practices that apply to multiple employees, says Garoon. “Having a plan with the same terms and conditions but different multiples at different tier levels gives peace of mind to all participants that they will be treated fairly,” she says. “It also avoids oneoff negotiations, which can trigger attention from proxy advisors.”

The report also showed that only a small minority of companies maintain single-trigger cash severance protection plans (5 percent), with most now requiring that both a change-in-control and a termination take place to qualify for a payout or equity vesting acceleration. “Having single-trigger equity acceleration creates problems if you want to keep executives, because it wipes out all of the employee’s retention glue during what can be a tumultuous time period,” explains Stephen Hom, a principal at FW Cook.

Examining CIC cash severance multiples revealed a consistent trend across all size companies of 2x to 3x salary-plus-bonus cash severance for CEOs and 1x to 2x salary-plus-bonus for CFOs in CIC scenarios, with 79 percent and 67 percent of the companies studied setting severance pay in those ranges, respectively. Health and welfare benefit continuation periods align closely with those cash severance multiples, according to the report’s findings.

The vast majority of companies are also in sync on treatment of CIC equity awards, with 92 percent fully accelerating vesting of stock options and 89 percent fully accelerating vesting of restricted stock units. The number is a little lower (71 percent) for performance awards, notes Garoon, likely because that type of incentive pay is typically structured to cliff vest at the end of a multiyear period rather than in tranches at regular intervals.

NON-CIC SEVERANCE PRACTICES

Adoption of non-CIC severance arrangements is slightly less common, at 74 percent of companies for CEOs and 68 percent for CFOs. The lower figure likely reflects the fact that guaranteeing severance pay for employees terminated due to subpar performance is less palatable for companies. Yet, as with CIC severance, non-CIC severance can be a useful recruiting tool, providing prospective hires with protection in situations such as a change in strategy or leadership transition.

Furthermore, the majority of executive terminations without “cause” ultimately result in some payment of severance, so having an upfront agreement can both smooth the process and appease regulators who might take a dim view of severance payouts that appear discretionary. “If severance hasn’t been agreed on up front, proxy advisors may view it as giving someone something special,” explains Silverberg.

Among the companies studied, 42 percent included non-CIC severance arrangements in employment agreements with their CEOs, while 32 percent included the CEO in a formal non-CIC severance plan covering multiple employees. The reverse is true for CFOs, with 41 percent of companies including CFOs in a formal, multi-employee severance plan, while 27 percent provided non-CIC severance through an individual employee agreement. A significant number of companies had no non-CIC severance agreement in place for CEOs and CFOs—26 percent and 32 percent, respectively.

Generally, non-CIC cash severance multiples are lower than CIC severance pay, at 1x to 2x, with 2x most common at the CEO level and 1x most common for CFOs. “A step down in multiple by tier is consistent across industries,” says Garoon. “So if you designate two years of severance pay for your CEO, it may be one year for your CFO, and then there may be another level that gets six months.”

Equity awards are another area where CIC and non-CIC severance arrangements differ. In CIC arrangements, the vast majority of companies accelerate the vesting of all outstanding stock options, while only 12 percent do so for non-CIC terminations. The majority practice in non-CIC arrangements is for employees to forfeit stock options (57 percent), restricted stock awards (53 percent) and performance awards (53 percent). “Most companies ratably vest time-based stock awards, so employees in a non-CIC severance situation are only really forfeiting portions of a year’s award,” explains Hom. “Then on the performance side, the thinking is that if you aren’t there to see the end of the three-year performance period, you shouldn’t benefit from the payout.”

While specific practices differ, both CIC and non-CIC severance arrangements should be viewed by comp committees as useful tools in recruiting, retaining and incentivizing top talent, as well as appeasing regulators at a time when executive compensation frequently comes under scrutiny. “Often, executives are being asked to move their families across the country, so severance arrangements can play a big part in negotiations,” said Hom. “It’s a good idea to put both arrangements in place and then do a pulse check on them every five to seven years.”

For more information about FW Cook’s 2023 Executive CIC and Non-CIC Severance Practices report, visit fwcook.com.