After a tumultuous year, the business environment ended 2020 on an upward momentum, and companies’ focus on seizing opportunities created by the crisis to drive growth has not yet subsided. Some experts say the U.S. economy is in for a harsh awakening once the stimulus and government support programs begin to fade—both at the corporate and individual level. Others believe the grounds gained by the acceleration of digital transformation have pushed us into a new era that is unlikely to snap back and won’t be deterred by new economic realities.

The reality, however, is that we are not fully out of the woods yet. Demand has surged in many sectors that were hardest hit by the pandemic, and states have begun lifting restrictions, allowing companies to return to some form of pre-crisis normalcy with employees on-site. But there have been upticks in Covid cases in certain regions and vaccine demand has stalled, leading some directors to worry about the speed at which we will truly recover.

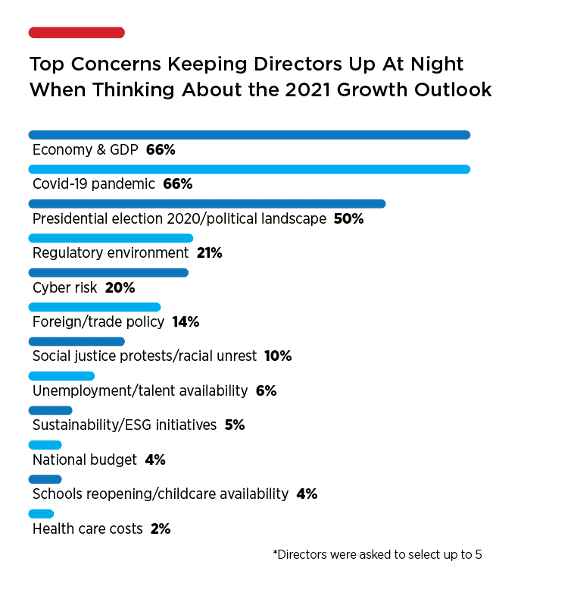

Whichever side of the conversation you’re on, there remains considerable risks on the horizon—as well as considerable opportunities. It is no surprise that fully two-thirds of the 400 directors surveyed by Corporate Board Member and Diligent Institute1[i] said the economy and the pandemic were the two areas they were most concerned would play a role in their recovery in 2021.

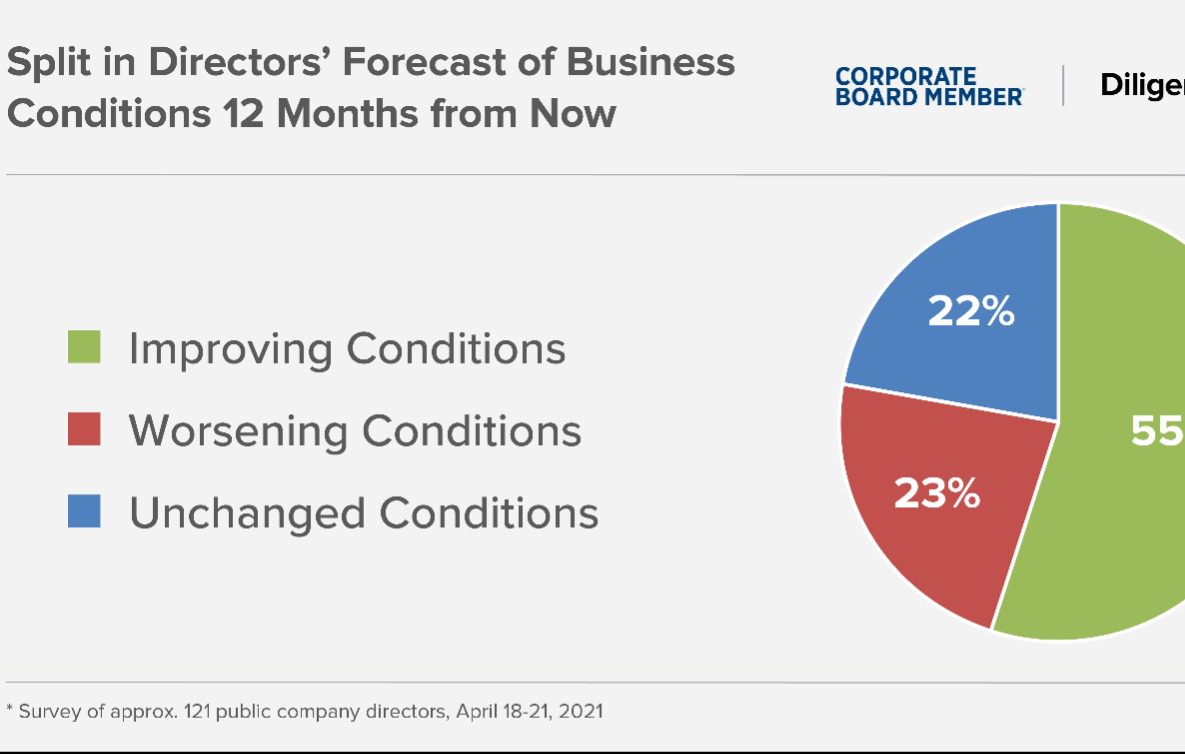

Board members say they are spending an increasing amount of time scenario-planning, and although 64 percent of them are forecasting increases in capital expenditures over the coming months2[ii], 45 percent say they expect conditions to either worsen or stagnate during the rest of the year.

Companies may be well served to embrace the opportunity for transformational change as a result of the pandemic by exploring new avenues to long-term and less-volatile value creation. Bringing in the necessary experience to ensure the board has a foundational understanding of potential disruptions (tech, health, social or otherwise) in this environment is warranted.

One such disruption is the intensifying focus on companies’ social responsibility. Protests and issues of racial inequality have been prominent over the past year, prompting corporations to take a long look inward at their human capital practices and talent strategies: 49 percent of directors participating in our What Directors Think survey said the push for enhanced diversity and inclusion (D&I) triggered new discussions at the board level about the company’s corporate citizenship—with another 41 percent saying there were no new discussions simply because D&I was already at the forefront of the board agenda. Only 10 percent said the recent social events have had no impact on their board discussions.

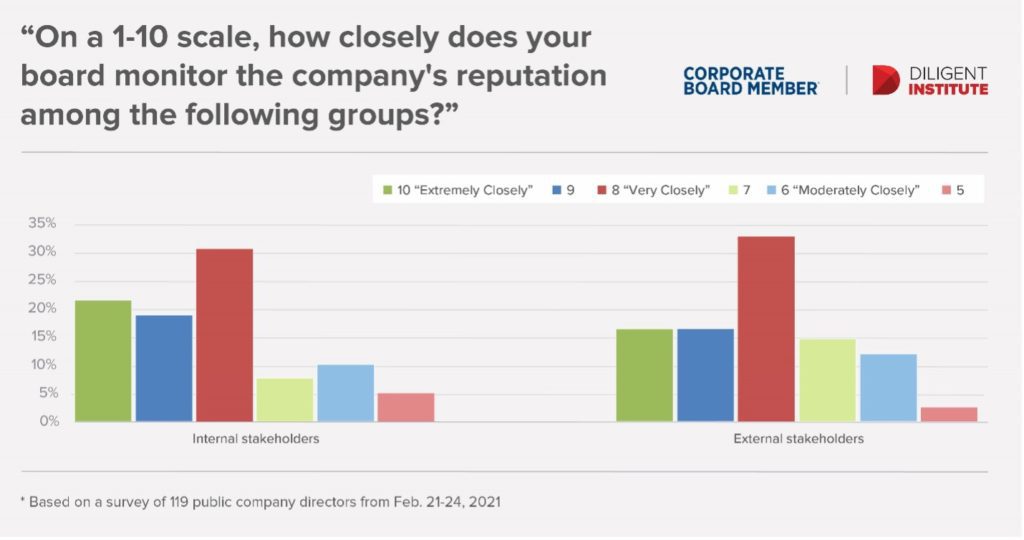

Most businesses have held deep-rooted values prior to this—it’s not an entirely new concept—but they have now been thrown full speed to the center of some of our biggest societal challenges. Corporations are now required to not only consider all stakeholders in their decision-making process but also provide full transparency into the final outcome—or lack thereof. This adds an incredibly complex layer to the board’s oversight role, with directors having to ensure management is driving a culture of equality across all aspects of the organization and that the company is looking at ways to reduce its operational footprint, no matter how small it may be. And with the Biden Administration implementing task forces to dig deeper into corporate filings on matters of ESG, it is no surprise that the majority of directors said they boards were monitor the company’s reputation very closely among all stakeholders—internal and external.

To navigate the current environment, boards need to remain vigilant. Directors should attempt to clarify the board’s role in political and reputational risk oversight, but they most importantly need to stay informed, with a close ear to the ground, as to what is being said about the company in all areas of the digital world.

Download your complimentary copy of our 2021 What Directors Think report to read more about boards’ outlook for the year ahead or browse through the findings of the Director Confidence Index, a unique leading indicator of public company director forecasts on business and the economy.

[i] Source: What Directors Think 2021 Survey, Corporate Board Member and Diligent Institute

[ii] Source: Director Confidence Index April 2021, Corporate Board Member and Diligent Institute