As investors, regulators, and stakeholders increasingly recognize environmental, social and governance (ESG) risks and opportunities as financially material, companies are looking for ways to link management incentives with ESG performance on climate change, diversity and inclusion, and other key issues. Though integrating ESG goals into the existing compensation program may seem like the obvious next step, there are several processes that board members need to implement first—and critical questions that they need to address—to ensure the new compensation structure is appropriately tied to corporate strategy.

As investors, regulators, and stakeholders increasingly recognize environmental, social and governance (ESG) risks and opportunities as financially material, companies are looking for ways to link management incentives with ESG performance on climate change, diversity and inclusion, and other key issues. Though integrating ESG goals into the existing compensation program may seem like the obvious next step, there are several processes that board members need to implement first—and critical questions that they need to address—to ensure the new compensation structure is appropriately tied to corporate strategy.

Ceres and the Semler Brossy have teamed up to provide guidance to companies that have begun to integrate ESG issues into their corporate strategies and may be considering ESG in incentives. This three-part series focuses on that process, including guidance to corporate boards on how they can: 1) effectively identify and oversee top ESG issues, 2) focus and clarify efforts around establishing a select set of critical performance goals for material ESG issues, and 3) consider whether and how to integrate ESG metrics into incentive compensation programs. In this first article, we will focus on how companies can implement the foundational steps of board-level ESG oversight.

The board’s role in ESG oversight

As stewards of long-term corporate performance, boards have a critical role to play in ensuring that companies are aware of, and able to navigate, an ever-evolving risk landscape—one that increasingly involves social and environmental impacts. It is the board’s responsibility to ensure that processes are in place to identify material risks and opportunities—including those that arise from ESG concerns. In doing so, directors should look beyond the information they receive from management and actively inquire about processes employed and issues identified. This is not only best practice, but a fulfillment of director fiduciary duty, which includes the “duty of care,” or responsibility to adequately inform oneself prior to making decisions.

The direct consequences of directors failing to take ESG concerns into account are growing. So-called Caremark claims, in which investors hold directors accountable for failing to implement or monitor key reporting systems, were dismissed for many years – but since 2019, five such claims have been allowed to proceed. Noting this trend, the Commonwealth Climate and Law Initiative recently published an analysis indicating that U.S. directors may be liable under the duty of care for failure to oversee climate risks, particularly if they ignore red flags from investors and other stakeholders. Such lapses may become increasingly obvious to investors as the US Securities and Exchange Commission (SEC) and other financial regulators implement and strengthen mandatory disclosure rules.

A first step for responsible board oversight is to assess the extent to which the company’s existing processes allow for systematic identification and assessment of ESG risks—and whether those processes are inclusive of a wide range of perspectives, to allow the company to consider risks that may not already be on its radar. This may involve internal and external research, engaging employees and customers, and consulting experts, such as insurance brokers and risk managers, to identify the set of issues the company should examine. Many companies hire outside consultants to do a full organizational review to determine top ESG risks, in addition to reaching out to top shareholders and other stakeholders to collect their views.

It’s important to remember that ESG issues present not only risks, but opportunities as well—new technologies, new product markets, and shifting customer preferences. Boards should ensure that management is also exploring the upside potential of ESG trends through strategic offsites or other regular meetings focused on defining and aligning the company’s strategic plan. As the Ceres Roadmap 2030 notes, leading companies will recognize that the integration of sustainability into governance systems enables opportunity for improved performance, risk mitigation, cost reduction, increased revenue and competitive differentiation.

The Board’s Role in ESG Risk and Opportunity Identification and Oversight: Questions for Directors to Ask*:

• Consider how ESG risks and opportunities could affect your company:

– What kind of risks or opportunities could ESG issues pose to the company?

– How could these risks and opportunities interrelate?

– When could these risks or opportunities manifest?

• Evaluate whether existing processes allow the discovery of ESG risks and opportunities:

– What is the company’s process to identify risks and opportunities from ESG factors?

– Which ESG risk factors is the company already tracking?

– Is the company looking at the right range of sources — including investors and peers – to identify risks and opportunities?

• Be aware of assumptions in the risk and opportunity identification process:

– Did management assess ESG risks and opportunities that the company could face in 1, 5, 10 and 20 years?

– What blind spots about ESG risks may exist in the risk identification process?

• Integrate identified ESG risks into the Enterprise Risk Management (ERM) process:

– Who owns the ERM process internally?

– Does the ERM process consider ESG risks?

– Is the ERM process agile?

*Excerpted from “Running the Risk: How Corporate Boards Can Oversee Environmental, Social and Governance Issues” (Ceres, 2019)

The company may already track some ESG risks within its Enterprise Risk Management system, without necessarily labeling them as social or environmental issues but rather as operational, supply chain or regulatory risks. Where material ESG risks are known, incorporating them into existing systems can help ensure they are taken seriously as business risks so that identification, prioritization and mitigation take into account their material financial impacts.

For many companies, existing processes are necessary but not sufficient for identifying ESG risks and opportunities—especially when the risks or opportunities are difficult to quantify or manifest over very long time horizons. In some cases, internal sustainability teams may be well aware of these issues, but the challenge is to incorporate them into organization-wide systems. Generally speaking, material risks identified in the company’s sustainability report should also appear in the company’s financial disclosures.

Boards should work with management to examine whether existing risk processes are sufficient, and how they might be strengthened. This may include evaluating business model assumptions. Practically, processes companies can adopt for identifying ESG risks can include megatrend analysis, SWOT analysis (which identifies strengths, weaknesses, opportunities and threats), impacts and dependency mapping, scenario analysis and facilitated stakeholder engagements. The Ceres report, “Running the Risk: How Corporate Boards Can Oversee Environmental, Social and Governance Issues” contains several toolkits to guide directors in these processes.

Board committee structure for ESG oversight

Integrating ESG considerations into boardroom decision-making on strategy needs to happen at both the full board and committee levels—with all significant ESG efforts being reviewed by the full board, at least at a summary level. In practice, this means directors need to ensure material ESG topics are standing items on the board’s agenda in order to address them systematically and integrate them consistently into strategic planning and execution. Without a systematized approach, companies will be forced to react with a crisis response when negative impacts occur and can miss out on opportunities presented by new markets and shifting customer and employee expectations.

The best way for boards to systematize ESG oversight is by amending one or more board committee charters to include formal responsibilities related to material ESG issues. This is important even for boards that are already engaged on ESG because charter language can outlast any individual directors or executives who may currently be driving that work— ensuring board oversight of ESG risks and opportunities both now and in the future.

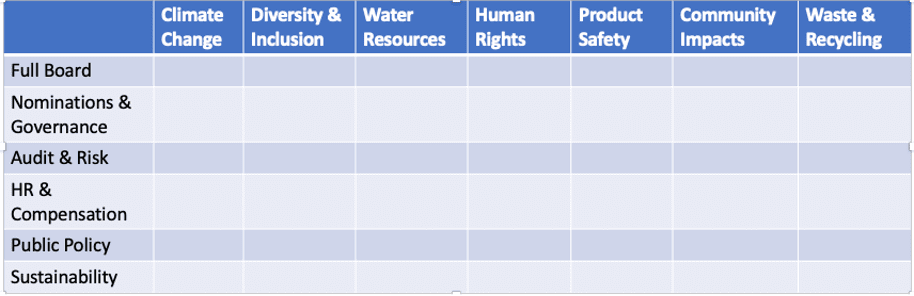

There are many models for board committee oversight, and pros and cons to each approach. One key decision is whether to establish a dedicated committee, such as a Sustainability Committee, versus integrating ESG oversight within one or more existing committees. For instance, an Audit and Risk committee could focus on material financial risks impacts of climate change, while a board’s Human Resources and Compensation committee may be best suited to oversee human capital issues in the workforce, such as diversity and inclusion and pay equity, and a Nominating and Governance committee may be the right body to ensure directors with appropriate ESG expertise serve in these committee roles. A simple mapping exercise of ESG issues and board committees can be useful, and may be modeled after the table below—adapted to fit the company’s material issues and committee structure.

One of the advantages of a dedicated ESG committee is that it signals, both internally and externally, that there is a commitment to keeping an eye on these issues and that they are important to the company—and ensures thoughtful deliberation of their business implications. On the other hand, a standalone committee can lead to siloed discussions of ESG topics, which might not be meaningfully connected to other business priorities that the board is driving. Integrating ESG oversight into an existing committee addresses this issue, but given increasingly crowded board agendas, it runs the risk of ESG issues being crowded out.

As of July 2021, around 88% of the S&P 100 had integrated ESG oversight into specific board committee charters. Nomination and governance committees were the most common placement for ESG oversight, with nearly half of companies (47%) placing responsibility there. The next most common placements were standalone sustainability committees (14%), audit, risk and compliance committees (10%) and public policy committees (10%). Around 4% of these companies integrated ESG oversight into multiple committee charters, and 3% placed it within a single committee other than the ones already mentioned. In the several months since, at least two companies that previously lacked committee-level responsibilities have integrated them—and, notably for this article series, about half of the Fortune 100 companies have expanded the names of their compensation committees to include broader human capital items including leadership or management development and people resources.

Examples of committee placement of ESG risks (Running the Risk, Ceres 2019)

| Board Committee: | ESG Risk Oversight Examples: | Company Example: |

| Audit/

Risk |

• Ensure material ESG risks are brought to the attention of the full board

• Ensure compliance with new ESG regulations • Disclose ESG risks in financial filings

|

Alphabet

(Audit and Compliance Committee) |

| Nominating & Governance | • Include ESG in board skills matrix

• Require board training on ESG • Integrate ESG in board performance evaluations

|

Mastercard[1]

(Nominating and Corporate Governance Committee) |

| Compensation/ Human Resources | • Incentivize executives to take action on mitigating risks from ESG issues

• Oversee policies and procedures on workforce development including safety and diversity • Engage with investors on ESG and compensation

|

T. Rowe Price

(Executive Compensation and Management Development Committee) |

| Sustainability/ Diversity | • Review key sustainability programs and related goals… and monitor the Corporation’s progress toward achieving those goals.

• Review and discuss the Corporation’s diversity, equity and inclusion policies, programs and initiatives. |

PepsiCo

(Sustainability, Diversity and Public Policy Committee) |

| Environmental Health & Safety | • Oversee acute and chronic impacts of hazards posed by the company to employees, contractors and the general public

• Oversee company response to developing EHS regulations and development of policies to comply, including those related to climate change

|

Consolidated Edison

(Safety, Environment, Operations, and Sustainability) |

At a management level, because the impacts of ESG issues can manifest across multiple areas of a business, an important structural element of managing ESG oversight and efforts is cross-functional collaboration. Boards should ensure that the management team not only has expert leadership for its most material ESG issues, but also that those leaders are coordinating with other teams across the company and they have a voice in strategic decision-making for the business. By asking ESG managers and business leaders to regularly present to the board, directors help ensure that this cross-organizational collaboration is taking place.

At the end of the day, there is no single solution for how to structure board oversight and companies should choose a model that best fits their own situation – but some formalized committee-level responsibility is crucial. It’s also critical to ensure that the oversight structure is reevaluated from time to time. Issues will continue to evolve, and the structures to address them will need to advance as well.

Below are examples of different approaches to committee oversight of ESG issues:

| Committee | Charter language | |

| Nike | Corporate Responsibility, Sustainability & Governance Committee | “Review and evaluate the Company’s significant strategies, activities, policies, investments and programs regarding corporate purpose, including corporate responsibility, sustainability, human rights, global community and social impact, and diversity and inclusion.” |

| FedEx | Nominating and Governance Committee | “Review and discuss with the Executive Vice President, General Counsel and Secretary, the Chief Sustainability Officer, and other members of management, at least annually, the Company’s (i) corporate social responsibility strategies and programs, including with respect to sustainability, and (ii) management of sustainability-related risks.” |

| Alphabet | Audit and Compliance Committee | “Review and discuss with management Alphabet’s major risk exposures, including financial, operational, data privacy and security, competition, legal, regulatory, compliance, civil and human rights, sustainability, and reputational risks, and the steps Alphabet takes to prevent, detect, monitor, and actively manage such exposures.” |

What about executive compensation?

We’ve now covered the first steps that boards need to take, which include ensuring the company is identifying and prioritizing key ESG risks and opportunities, and formalizing and structuring board oversight of ESG. With those practices in place, boards can move towards measuring, monitoring and tracking key ESG metrics over time, establishing appropriate goals, communicating those metrics and goals to key stakeholders, and considering the metrics for incentives. These are subjects that will be covered in articles II and III of this series.

[1] More information can be found in Mastercard’s 2021 Proxy Filings.