As discussed in part I of this series, A Board’s Guide to ESG and Incentives: Effectively Identifying Top ESG Priorities, before an organization can link executive compensation to environmental, social, and governance (ESG) goals, it must establish methodologies for identifying material ESG risks and opportunities and board oversight. Once top ESG risks and strategic opportunities have been identified, a company will need to focus action on the key issues. From the board’s perspective, this will involve two large buckets: goal setting and communication.

ESG goals tend to have long time horizons—often longer than the tenure of the current executive team. This is why, in our previous article, we emphasized the need to institutionalize ESG oversight—so that it can be consistently applied as executives come and go. But within the tenure of the current executive team, certain actions can be incentivized so that individual leaders do their part to keep the organization on track.

Setting ESG Goals

An essential function of a corporate board is to ensure that management is setting clear, meaningful goals that address organizational priorities. In the case of ESG performance, this often includes greenhouse gas (GHG) emissions reduction goals and diversity, equity, and inclusion (DEI) workforce goals, and may also include other material issues, such as water use or operational safety, depending on the industry.

| ESG Issue | Goal Expectations | Company Example |

| Greenhouse Gas Emissions | Scope 1, 2, and 3 greenhouse gas emission reduction targets (including short- and mid-term milestones) aligned to the most current science, or set such a target within 24 months. | JLL was one of the first companies to develop a science-based net zero target verified by the Science Based Targets Initiative (SBTi). This target aims to reduce emissions across all scopes by 51% by 2030, and 95% by 2040 from a 2018 baseline. PSEG has pledged to reach net zero emissions by 2030 and also to develop SBTi approved and aligned targets. |

| Human Rights | Policy that clearly articulates respect for the human rights of both direct and indirect employees, preferably aligned with UN Guiding Principles for Business and Human Rights. | HP, ranked #1 in ESG performance in 2021 by Newsweek, set a goal to assure respect for labor-related human rights for 100% of its key contracted manufacturing suppliers. HP conducts human rights due diligence assessments to identify and mitigate risks across its value chain and established a Racial Equity and Social Justice Task Force to drive industry change. |

| Diversity, Equity, and Inclusion | Targets to improve representation, on a path to achieving equity for women and other historically disadvantaged and underrepresented groups across the workforce. | Edison aims to reach full gender parity for executive positions by 2030, a goal it set when it joined Paradigm for Parity, a coalition of business leaders dedicated to addressing the leadership gender gap in corporate America. Nike set a 2025 goal to increase representation of women and of racial and ethnic minorities in its corporate workforce and in leadership positions. Nike’s goals also extend into its supply chain, with an aim that 100% of its suppliers will have gender equitable work places by 2025. |

| Water and Natural Resources | Policy or commitment, as is sector-relevant, to conserve and protect water and natural resources, on a path toward future resource positivity. | Amgen announced in 2021 the goals of reducing water use 40% and waste disposal 75% by 2027. Sub-goals include implementing specific projects and initiatives across its operations. General Mills establishes multi-stakeholder, science-based water steward action plans for 10 priority watersheds under stress, involving local communities, industry, agriculture and government in decision making and water protection. |

These goals may seem simple in high-level communications, but the definitions behind them are nuanced and important. Taking GHG targets as an example, the company’s goal may be “net zero emissions by 2040” – a very concise articulation of a complex goal. Boards and management should be able to answer questions from key stakeholders – like investors on:

• Does this goal cover only operational emissions or does it include value-chain emissions? How are scopes 1, 2, and 3 being addressed? Has this goal been certified by the Science Based Targets initiative (SBTi) or at least filed with the organization for consideration?

• What will the role of offsets be in reaching net zero emissions? How extensively will they be used, when will they be introduced, and how have they been verified both for their environmental and social impacts?

• How will management oversee progress towards the goal? Is there a cross-functional team meeting on a regular basis? Have consultants been hired to do a GHG inventory?

• How is this goal being communicated, both internally and externally?

Social goals are also very nuanced and require careful definition. Take, for example, the seemly straightforward goal of gender equality, which raises the following questions:

• If the ultimate goal is 50/50 representation, what is an achievable timeframe?

• Does this apply to all employees or just the leadership level?

• If at a leadership level, how is that defined?

• What programs should be incentivized in order to reach that goal?

• Should transgender rights be addressed within these goals?

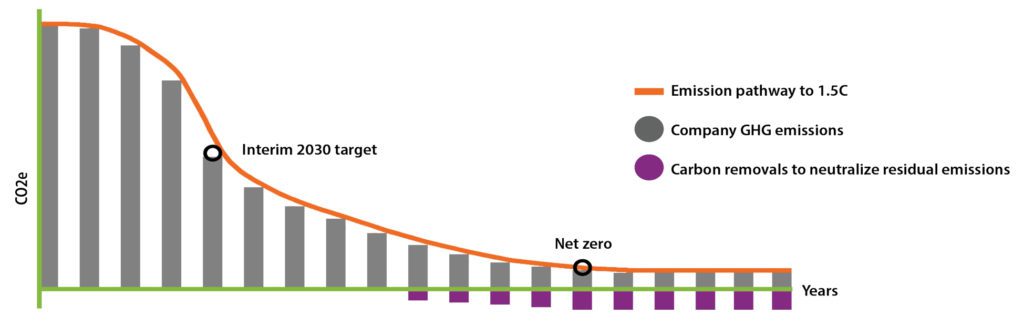

Once management and the board have fully articulated these ESG goals, they can be seen as specific destinations on a longer journey. The company will need to map out a route to get to each of them by defining interim targets with dates, creating business plans, and allocating the necessary capital. For example, achieving GHG reduction targets may involve decarbonizing the company’s capital stock and committing to align future capital expenditure with the Paris Agreement’s objective of limiting global warming to 1.5 degrees Celsius.

Developing Interim Targets and Transition Plans

Ambitious goals can only be achieved if strong steps are taken to get there. For addressing the climate crisis, long-term (e.g., decades-long) mitigation goals need to be broken into shorter term goals that executives can address during their tenure. Pathways to net zero by 2050 or even 2040 will need interim targets for 2030—and standards are evolving around these, with an ambition of 50% reduction recommended by groups like the Science Based Targets initiative (SBTi) and Climate Action 100+.

As we write this in 2022, even those interim climate targets are quite far away—and there is a growing push by investors and advocates for companies to develop “transition plans” to plot the steps needed in smaller and more actionable increments.

The Ceres Roadmap 2030 provides a blueprint of action steps companies need to take to succeed in a sustainability challenged economy and it lays out critical milestones they should reach in five-year increments to stabilize the climate, protect water and natural resources, and build a just and inclusive economy. Those steps include key business integration actions that embed ESG goals in strategic planning, governance, disclosure, and throughout the value chain.

Beyond breaking down goals into manageable timeframes and action steps, companies also need to break down responsibility for implementation into specific teams and individuals—creating clarity around how executives and employees can and should impact ESG performance. Nike, for example, established 29 targets for 2025 focused on “People, Planet and Play” and holds everyone in the company accountable for achieving them, especially top management whose compensation is tied to those targets.

Investor expectations for credible business plans are still evolving, but some general guidelines can be found in Ceres’ Investor Guide to Corporate Greenhouse Gas Commitments. This resource defines strong transition plans as those that:

• Set interim GHG reduction goals that will support the company’s longer term goals.

• Cover carbon dioxide, methane, fluorinated refrigerants, and nitrous oxide.

• Specify the investments, projects, and actions a company will take to meet its goals.

• Apply to the entire value chain and all business units under the company’s operational/financial control.

• Include engagement in policy advocacy that, at minimum, aligns with the company’s own GHG goals, and ideally aligns with the goals of the Paris Agreement.

• Disclose the company’s use and reliance on carbon credits.

• Annually disclose the company’s progress towards its GHG goals.

While there is an intense focus on climate targets and climate transition plans right now, these ideas apply to other ESG goals as well, such as diversity and inclusion. For instance, in 2018 Goldman Sachs set a goal to eventually have 50% of its global talent represented by women. To get there, the company set interim gender diversity goals that include that:

• Women make up 50% of campus analyst hiring by 2021

• Women make up at least 30% of UK senior talent (VP or above) by 2023

• Women make up at least 40% of VP-level executives by 2025

In the case of zero-tolerance goals, such as worker safety or forced labor, reporting incremental progress towards the ultimate goal may not be appropriate; “fewer on-the-job fatalities” simply doesn’t capture the critical importance of keeping all workers safe. In these instances, the company can report on steps taken to ensure the ultimate goal is met as soon as possible. These steps may include supplier agreements signed, factory audits conducted, or safety trainings completed.

Where interim targets are appropriate, they can encourage managers to take the initial steps that will build a foundation for pursuing the broader goal, and subsequently can reveal whether a company is “on track” at any point in time—or whether course corrections are needed. In addition, these interim targets and plans are essential to reassuring investors and other stakeholders that the ESG goal itself is a credible one. Companies are no longer receiving credit simply for ambition if that ambition is not backed by key actions.

Establishing a Stakeholder-Centric Communication Strategy

Once companies have broken down longer-term aspirational goals into interim steps, companies can communicate both sets of goals to employees and external stakeholders in the context of the broader ESG story. Such goals become real and purposeful only as the full organization incorporates them into their daily operations.

For goals set to meet basic performance standards, boards can ensure management emphasizes steps they’re taking to align with peers and external expectations. For “differentiation” goals requiring exceptional performance, boards can receive updates from management on how their progress compares to ESG leaders to ensure that goals are sufficiently challenging.

Companies will be more effective in their communication if they’re able to link their ESG strategies to the company’s mission and purpose. Starbucks ties its aspirations to have a positive impact on people, communities, and resources to its mission to inspire and nurture the human spirit. Companies will also benefit from providing details on the company’s current state relative to both interim goals and longer-term aspirations. A scorecard that tracks a company’s progress can be shared both internally and externally. Communicating progress against peer benchmarks or company rankings such as those on Just Capital can likewise help shape the overall narrative.

Preparing for Employee Communications

Effective communication requires understanding the audience’s starting point. Pulse surveys can help companies learn how employees currently see the company’s ESG commitments and efforts and indicate employees’ receptivity and eagerness to work on related initiatives. Short “pulse” surveys repeated over a few months tend to yield better results than one long survey.

Differences in survey responses across business functions, geographic locations, or demographics could justify targeted communications for specific subsets of the employee population. The surveys can also provide companies a helpful window into the organizational culture, especially as to whether employees feel included and heard.

Boards will benefit from further management insights from exit interviews and external rating sites such as Glassdoor. While these sources may be less representative, they often provide a depth and frankness missing in the surveys.

Embedding ESG into Company Culture

Companies can communicate their ESG goals not just for transparency but also to change behaviors. Messaging should be released at regular intervals, rather than all at once. Ideally, it would be included in existing communication channels to reinforce the idea that ESG is now a normal part of company activities—not a “flavor of the month.” Regularly posting progress against ESG goals in common areas in corporate offices, manufacturing plants, distribution centers, and other employee hubs as well as on the company website can also help to generate excitement and focus among employees. Progress against interim goals could be disclosed in a scorecard format using a “traffic light” color coding system where “green” would reflect successful and timely achievement of goals, “yellow” would reflect in-progress performance, and “red” would reflect shortfalls or delays. Disclosing specific action steps that led to key accomplishments and/or steps that can be taken to address shortfalls can be helpful guidance for employees.

Many companies regularly discuss financial or strategic accomplishments at town hall or all-hands meetings. The same can be done for communicating ESG accomplishments. Nike takes an ‘always on’ approach and uses a variety of platforms, including global all employee meetings, Q&A forums with its Purpose leadership team and leader messaging to embed Purpose across the business, as well as various internal content series featuring the people and initiatives that help deliver against its commitments.

It is important that the CEO and senior leadership members are visible in presenting updates on ESG goals and initiatives and report on measurable progress in subsequent staff meetings. Each ensuing discussion reinforces the reality and normalcy of the goals and demonstrates how short-term actions help accomplish long-term goals. Companies can also use town halls to introduce employees to internal leaders tackling material ESG issues to show commitment and buy-in and make ESG commitments more real. From there, companies can help facilitate collaboration between sustainability, human capital, risk, and business leaders to break down barriers and align employees across the organization on common goals.

Business leaders can encourage employee teams to brainstorm methods for employees to engage with corporate ESG priorities, and then distribute these engagement initiatives to the broader workforce. People are far more committed to carrying out plans that they devise themselves.

Employee resource groups for members of underrepresented groups, often developed and organized by employees, are a popular way to help meet goals on diversity, equity, and inclusion by fostering a greater sense of belonging and promoting retention of diverse employees. These groups can also serve as a channel for communicating ESG priorities, as a resource for developing ideas for further ESG or DEI initiatives and updates, and as a way to help gather more in-depth feedback on the implementation of existing initiatives.

Employees are critical in driving progress against ESG initiatives, so companies must ensure they effectively communicate the initiatives at the right time and fully embed them into the company culture.

Communicating with Investors

As for external stakeholders, investors increasingly want to hear more about companies’ ESG strategies so companies should ensure that their ESG narratives respond to that interest and are consistent across all platforms. Aside from the required disclosure in the 10-K, companies have an opportunity to showcase their goals and accomplishments in other areas. For some companies, the proxy is becoming a one-stop shop—Starbucks has taken this approach. Other companies include sections on ESG on their websites or in separate standalone ESG reports. Voluntary disclosures often provide room for longer narratives that describe how ESG initiatives tie into the corporate mission. Macy’s Human Capital Report includes video testimonials from employees and examples of initiatives.

There are good examples of companies disclosing ESG commitments in investor presentations to demonstrate the importance of ESG relative to other financial and strategic priorities. Lowe’s recently included its ESG initiatives on the first page of its 2022 financial outlook presentation before diving into its strategy and financial expectations for the upcoming year. Disclosing specific goals also helps to reinforce a company’s commitment to ESG. Sonos includes both short- and long-term goals in its Sustainability and Climate Impact report. To take it one step further, companies can publish a scorecard of their interim goals. These scorecards would signal to investors where companies stand in terms of executing against their longer-term aspirational goals.

Finally, companies can use existing shareholder outreach to share the ESG goals and understand investor priorities and expectations. Directors—typically the board chair or lead independent director— increasingly participate, confirming the board’s role in overseeing ESG matters.

Highlighting ESG to Other Stakeholders

To spread awareness of company ESG efforts more broadly beyond employees and investors, companies can include ESG in branding and marketing materials. In 2020, JetBlue was the first U.S. airline to commit to carbon neutrality for all domestic flights. Passengers heard all about the airline’s goals in this area through marketing materials on flights. Panera’s mission for a “healthier and happier world” is evident in its menus—the company has partnered with the World Resources Institute to measure the carbon footprint of menu items and label low-carbon entrees as Cool Food Meals.

Companies can also explain supplier requirements and expectations in support of ESG programs. BD’s website discloses its supplier code of conduct with standards of social responsibility, environmental stewardship, ethical practices, and governance.

—

As companies further develop their ESG strategies, boards will want to consider the best ways to reinforce the goals, including linking them to executive incentive plans. This topic will be covered in the last article of this series. Including ESG metrics may not be the right approach for all companies, but it can offer an additional lever to ensure leaders’ attention and accountability as well as another avenue to demonstrate a company’s ESG commitment.